Corporate risk radar

报告简介

产品

2024年9月18日

作者:

下载Introduction

Navigating geopolitical and technology upheaval

Part One of the Corporate risk radar report examined the ‘polycrisis’ facing leaders in 2024 - economic volatility, geopolitical turbulence, regulatory complexities, talent shortages, and the disruptive force of Artificial Intelligence (AI).

Part Two provides actionable insights and solutions for achieving the speed and adaptability needed to meet these challenges head-on, focusing on:

Finding opportunity in the risk

The 2024 Corporate risk radar reveals a critical ‘agility deficit’ threatening organisations' ability to navigate the volatile geopolitical and technology risk landscape. In an increasingly complex risk environment, businesses, which can overcome this, are ideally placed to capitalise on wider inertia.

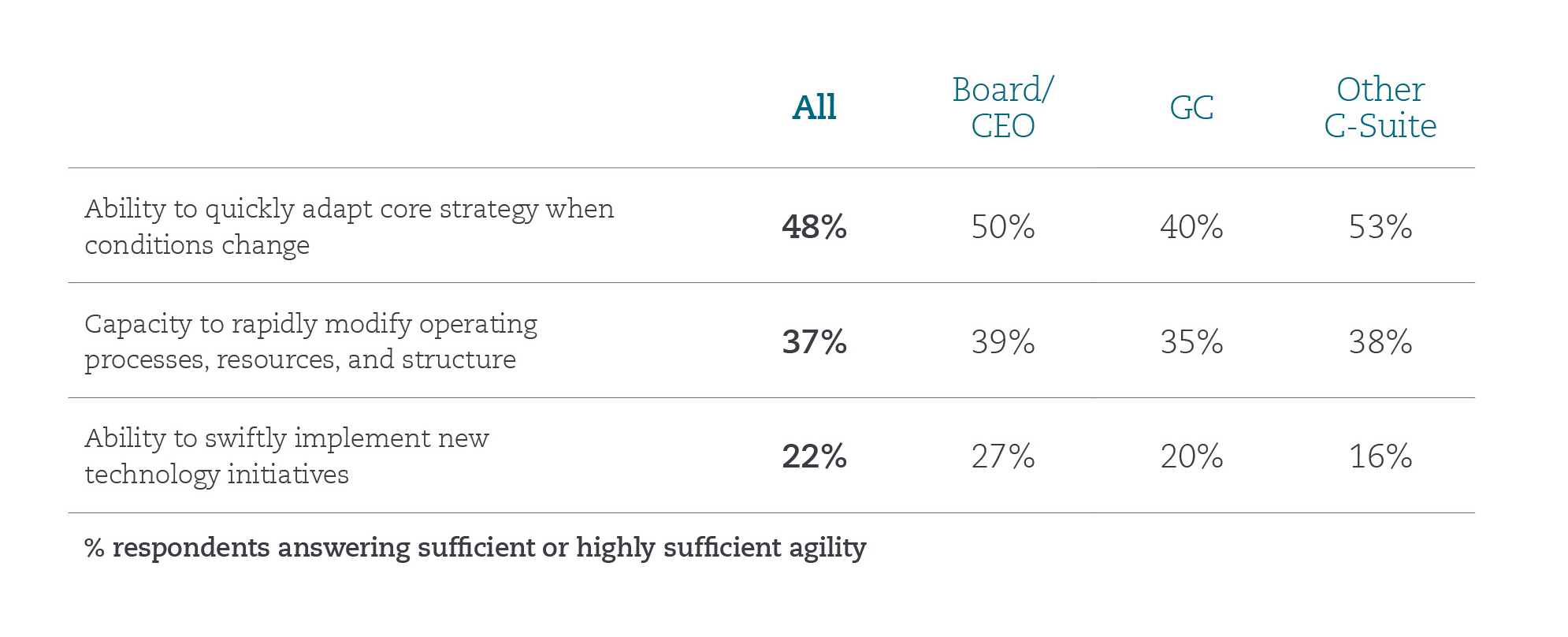

Despite agility being widely recognised as a strategic imperative, less than half (48%) of respondents believe they can adapt their strategies to changing circumstances, only 37% feel equipped to modify operations, and a mere 22% are confident in implementing new technologies rapidly. The lack of technological agility is particularly concerning, given the challenges presented by generative AI.

To address the ‘agility gap’ a purpose-driven leadership approach is needed to encourage rapid cross-functional collaboration, and a shift from rigid structures to dynamic teams, building a culture that encourages employees to take calculated risks and challenge the status quo.

The risk conversation is now much more in depth than it was ten years ago. Every element of liability is on the table, being discussed up front. On arriving in a new country, companies now have detailed exit plans clearly articulating how they might exit a jurisdiction in years to come, if the risks are too great. Inevitably, there’s going to be a certain amount of ‘Keep calm and carry on’. Large investments can’t suddenly move the next day. It’s about understanding the risks and having clarity over the implications.

Eva-Maria Barbosa, Partner, Munich

Response to geopolitical volatility

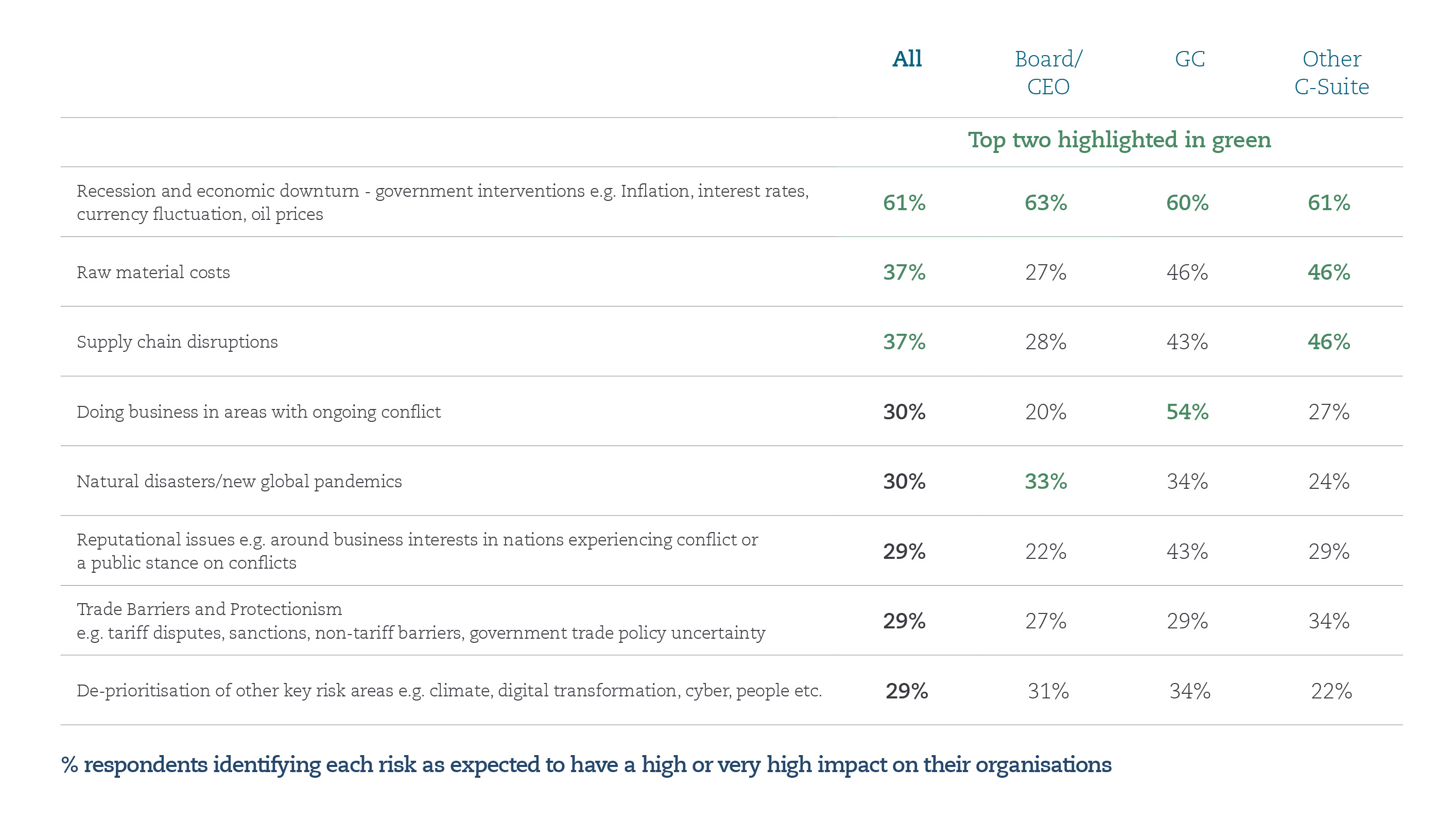

Geopolitical risk is the fastest-growing 'high impact' risk in 2024. The top concern among respondents is the threat of ’Recession’ (61%), followed by ’Raw material costs’ and ‘Supply chain disruptions’ (both at 37%).

The wider geopolitical landscape is having a huge impact on supply chains, the time and cost for construction projects, which is exacerbated by broader economic instability. The world is far more complicated for businesses than it was three or four years ago. For Eastern European people and businesses, the biggest concern is the Russia-Ukraine war seeping into their borders. Nonetheless, the war has not dampened interest in investing in Poland. The climate impact of war must also be factored into the cost of rebuilding.

Agnieszka Kulińska, Partner, Poland

In response, businesses are strengthening their horizon scanning capabilities, operational resilience, supply chain robustness, embracing 'nearshoring,' (the practice of relocating business operations to a nearby country to reduce dependency on potentially unstable supply chains) and fostering stronger supplier relationships.

While international investments in the Middle East have slightly decreased this year compared to previous years, this has given a great advantage to Middle Eastern investors to invest more outbound, we have seen a huge increase in transactions with US and Latin American targets.

Roshanak Bassiri Gharb, Partner, Dubai

GCs are more sensitive to risks such as ‘Reputational issues’ (43%) and ‘Doing business in conflict areas’ (54%) than their board and C-Suite peers, but they also feel more prepared to tackle these risks.

Although the onset of the war in Ukraine triggered an elevation of the risk landscape for businesses in Singapore and across Southeast Asia, it has remained relatively static and businesses are operating at a new normal. Risk assessments and scenario planning exercises have become more commonplace and have helped businesses operate with greater confidence in our core sectors, such as, for example energy and ports.

Ton Van Den Bosch, Partner, Singapore

Harnessing AI and tech for growth

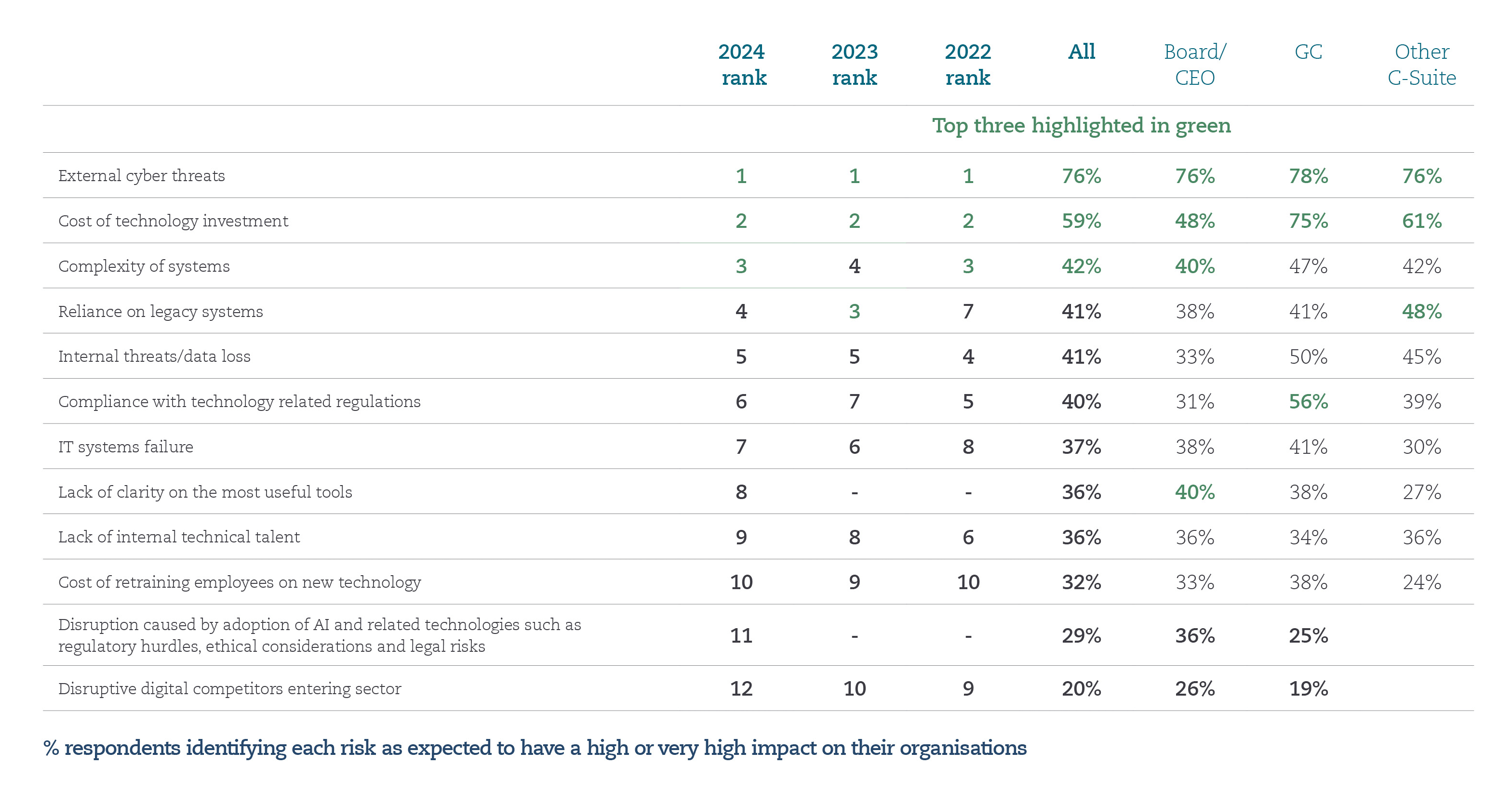

While generative AI offers immense potential for growth and efficiency gains, it has amplified perception of ‘External cyber threats’ (76%), ‘Compliance risk’ (40%) and ‘Complexity of systems’ (42%). Over a third feel (34%) unprepared for ‘Disruption caused by adoption of AI’.

To address these technology challenges, organisations are prioritising robust cyber defence, developing specific policy solutions to evaluate potential AI risks and returns, regulatory compliance, and strategic alignment of investment with business goals.

Leaders saw AI coming over the horizon, but they were not quite sure how to use it themselves as part of their own organisations. And now they are not really clear what the potential risks are for their organisations either. People are still feeling their way around the edges.

Tom Tippett, Partner, London

The number one priority a corporation should have on AI, is having a comprehensive AI policy in place before a single cent is spent. Too often we are seeing organisations repent at leisure, having failed to successfully navigate issues pertaining to AI that would have been identified as part of an upfront AI policy screening process.

Chris Williams, Partner, London

Regulatory risk

Regulation and compliance continues to be perceived as one of the top three high-impact risks to businesses in the next two to three years, with 58% of senior leaders identifying it as a burden. Somewhat unsurprisingly, this sentiment is most pronounced amongst legal teams, with 74% of general counsels highlighting it as a top risk, a 13% rise from the previous year.

Over two fifths (43%) see the management of regulatory issues as a growing threat, partly driven by a time and budget constrained commercial environment, and some frustration at new regulatory initiatives. Frustration is also expressed at a perceived lack of clarity and certainty in regulatory frameworks, caused by inconsistency and instability amongst some political institutions and governing bodies. 68% said that risk horizon scanning had become a more important part of their role than it was a few years ago.

Businesses across multiple sectors have been grappling with an ever-increasing burden of regulation. This trend has had significant implications for operational efficiency, compliance costs, and strategic planning.

Have you watched our new interactive brochure on our global regulatory & investigations offering?'

Regulatory & Investigation interactive brochure

The better the region is regulated, the easier it is for international investors to enter the market, and for regional conglomerates to grow as they can point to the relevant frameworks and rely on the regulations. This might slightly reduce flexibility and freedom to make business decisions or change direction, but regional and multi-national investors have proven to be willing to comply with the rules as they already have the necessary structures in place and see the opportunity for growth.

Roshanak Bassiri Gharb, Partner, Dubai

A contrasting global talent map

People challenges – attracting and retaining staff, upskilling staff, talent management and succession planning – is cited in this year’s report as the second biggest high impact risk facing corporates today. 58% of respondents identified people challenges as likely to have a high impact on their organisations in the immediate future.

Two years on from the end of the global Covid pandemic, organisations are still grappling with the after effects of the crisis, but the risks are increasingly diverse, predicated on location and sector. Rising to the challenge of such risk requires delivery of bespoke responses.

If you would like to speak to us about the risks you’re navigating, please get in touch in the link below.

Respondent profile

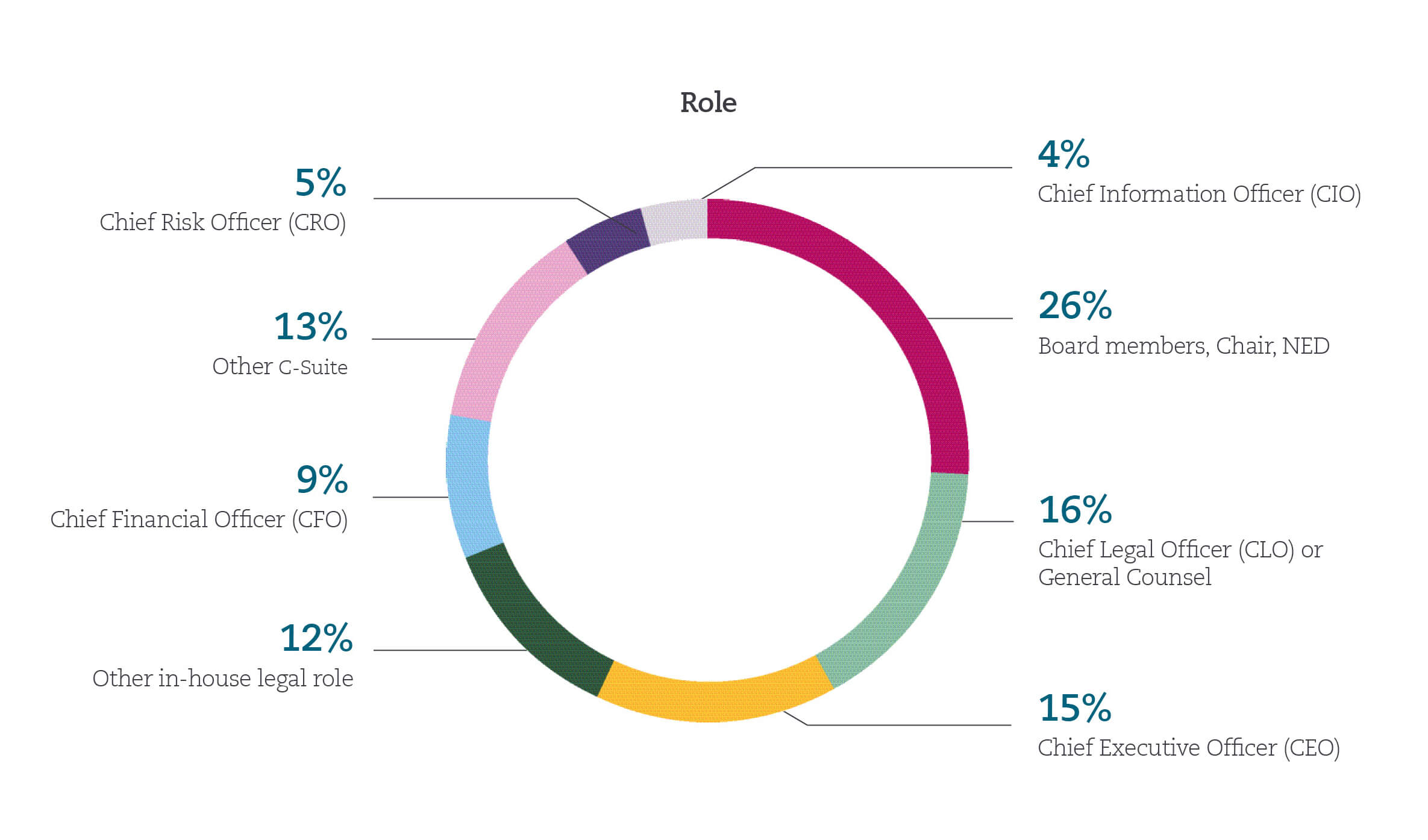

225 interviews (215 online and 10 qualitative) with senior business leaders (our largest sample to date)

The organisations we have consulted have a global presence, with over a third headquartered outside the UK (Europe 10%, Asia-Pacific 10%, North America 6%, Africa 7% and Middle East 2%) and with operations and individual professional responsibility at a global level.

结束

Partner

Partner

Partner

Partner

Partner

Partner

Partner

Partner

合伙人兼亚太区董事会主席

Partner

Partner