报告简介

产品

2021年9月15日

作者:

阅读时间

15

下载1. Introduction

For the third year running, Clyde & Co has researched the outlook for the MGA market over the next 12 months, such as the impact of COVID-19, carrier partnerships, and the changing claims management process.

Foreword

2021 has all the makings of a year of renewal for MGAs.

The impact of the Lloyd’s Decile 10 remediation process and a global pandemic led to capacity providers taking a long hard look at MGA partnerships and questioning the value they provide.

But following some challenging renewals in 2021, it is clear from our data, backed up by discussions with MGAs and capacity providers, that the future of the sector is very promising and the mood is most definitely upbeat.

While work remains to be done in terms of tightening wordings, leveraging technology and improving claims management, as we look ahead, it is clear that markets, including Lloyd’s, are receptive and opportunities are there for the MGAs that can deliver.

Over 50 MGAs and carriers participated in our survey. Our survey found:

Key findings

Confidence is recovering

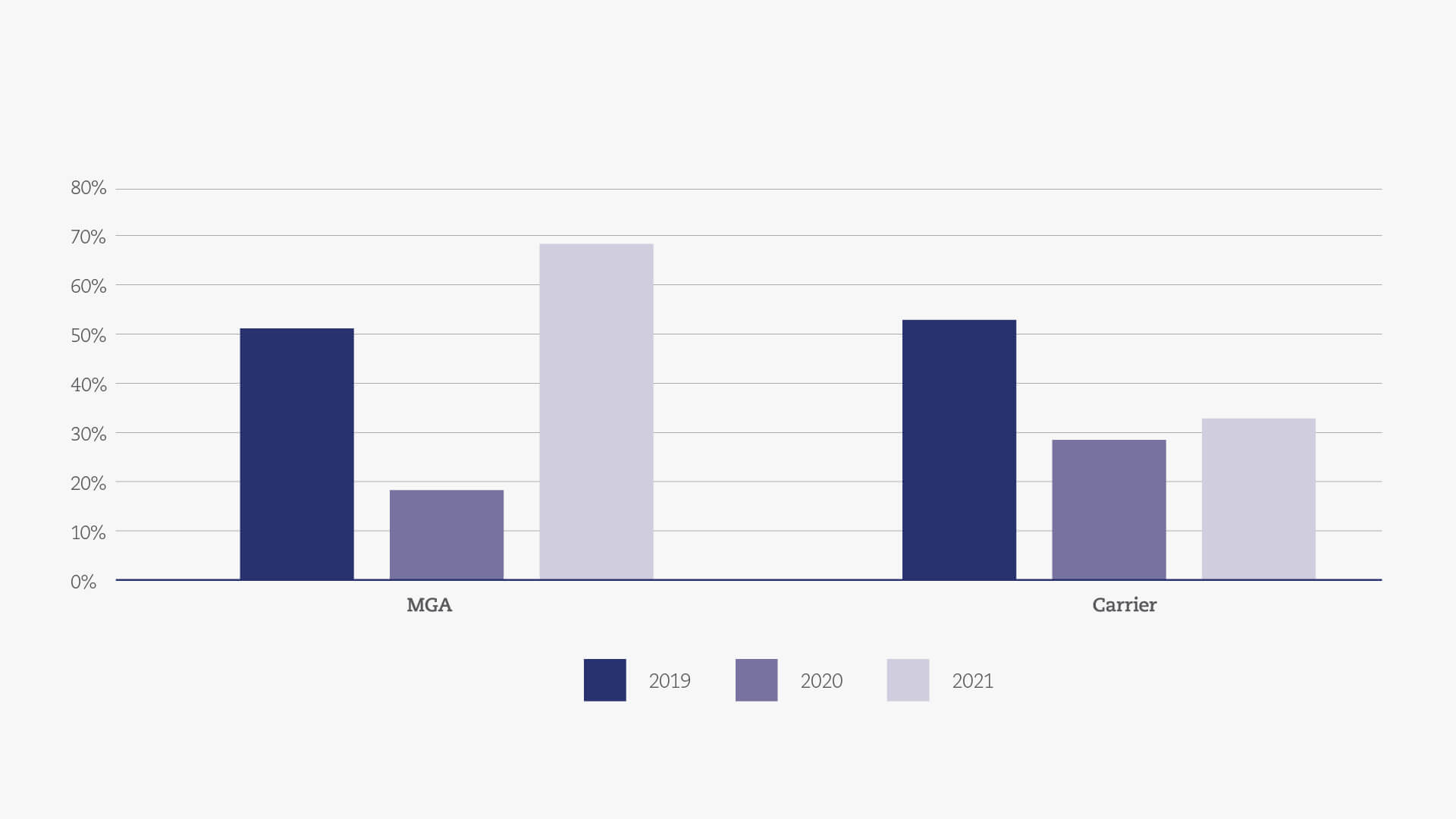

Although this level of confidence is not matched by the insurer community, which historically has been more cautious, carrier appetite for MGA business has nevertheless increased by four percentage points against 2020 levels.

A number of factors are driving MGA confidence, with the most dominant that the majority of MGAs have not only survived, but thrived following the highly testing conditions triggered by the Lloyd’s Decile 10 reform programme and compounded by the pandemic.

Against the backdrop of a hardening market, how do you expect your partnerships to evolve into 2022? Proportion answer "increase"

Covid impacts vary

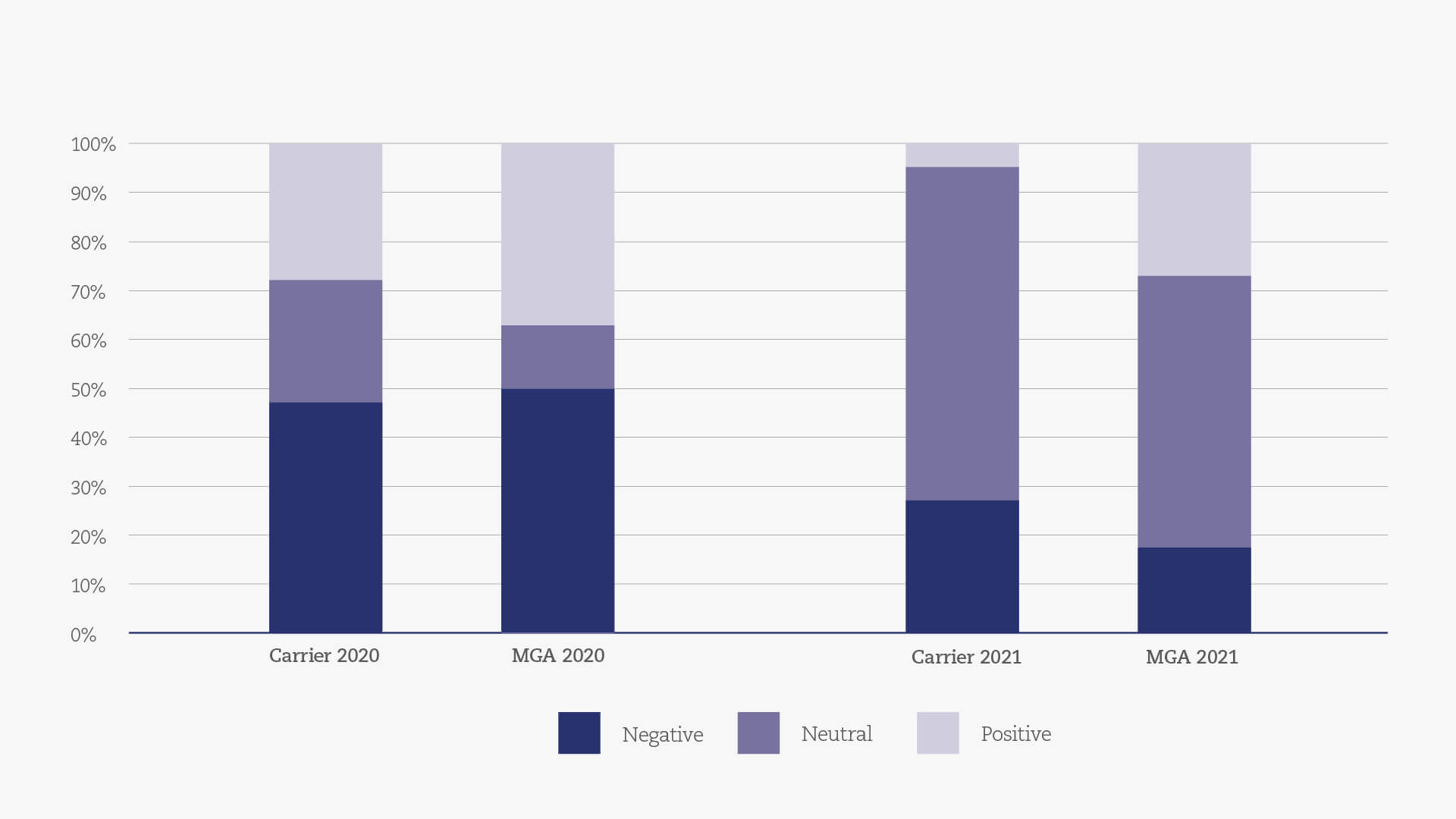

While carriers remain cautious about expanding the number of partnerships in this space, sentiment is definitely warming, with the majority assigning a ‘neutral’ verdict to the impact of Covid on capacity allocation, a distinct improvement on last year. In what is still a relatively small MGA community, it only takes positive interest from a few key carriers to make a difference.

Although conversations between MGAs and providers have been challenging for the past 18 months and are likely to remain so, it is clear that businesses which are able to generate a consistent return are finding success and looking ahead to the next set of renewals with a greater degree of confidence.

But although the capital impact of Covid seems to have been relatively short-lived, it is evident that some of the coverage issues raised by the pandemic are casting a longer shadow in terms of enhanced scrutiny over wordings and more focus on due diligence when onboarding new relationships.

What has been the impact of Covid-19 on your capacity allocation in 2021?

All change on markets and models

2021 sees a sharp reversal of that picture. The market is more popular with carriers than it has ever been – almost half (47%) believe that it provides the best environment in which to grow and develop MGA business.

Against this backdrop, the tailwind of capital flooding into the MGA space suggests there may be a pick-up in the adoption of alternative capital, including ILS, PE, reinsurance, investment funds and even MGAs own capital over the next 12-24 months.

It is also clear that the appeal of the US is growing. Historically, Lloyd’s has seen a lot of program business through MGAs in the US. With rates rising, our data shows that interest is once again, with both carriers and MGAs citing the US as a strong market to grow and develop.

Pillars of partnership

Delegating authority to access US personal lines or SME business makes sense for those wanting a share of the action in the world’s largest insurance market. Participation in this business fell back as a result of Lloyd’s remediation focus, but with rates rising, our data shows that interest is once again, with both carriers and MGAs citing the US as a strong market to grow and develop.

Against this backdrop, MGAs need to add value by opening up new opportunities either in terms of distribution or of underwriting rather than simply amplifying existing carrier competencies.

Strong performers that can add value in niche markets are valued highly by carriers, with 60% of carriers citing this as a top three requirement of their MGA partners. Moreover, strikingly, 100% of carriers cited the importance of technology expertise and data mastery to ensure good risk selection and pricing, a finding echoed by 89% of MGAs.

As in previous years, MGAs continue to prioritise market reputation of their paper provider as a key pillar of partnership but, reflecting the experience of the past year, a resounding 89% favoured capacity stability in carrier characteristics.

Claims outlooks remains challenging

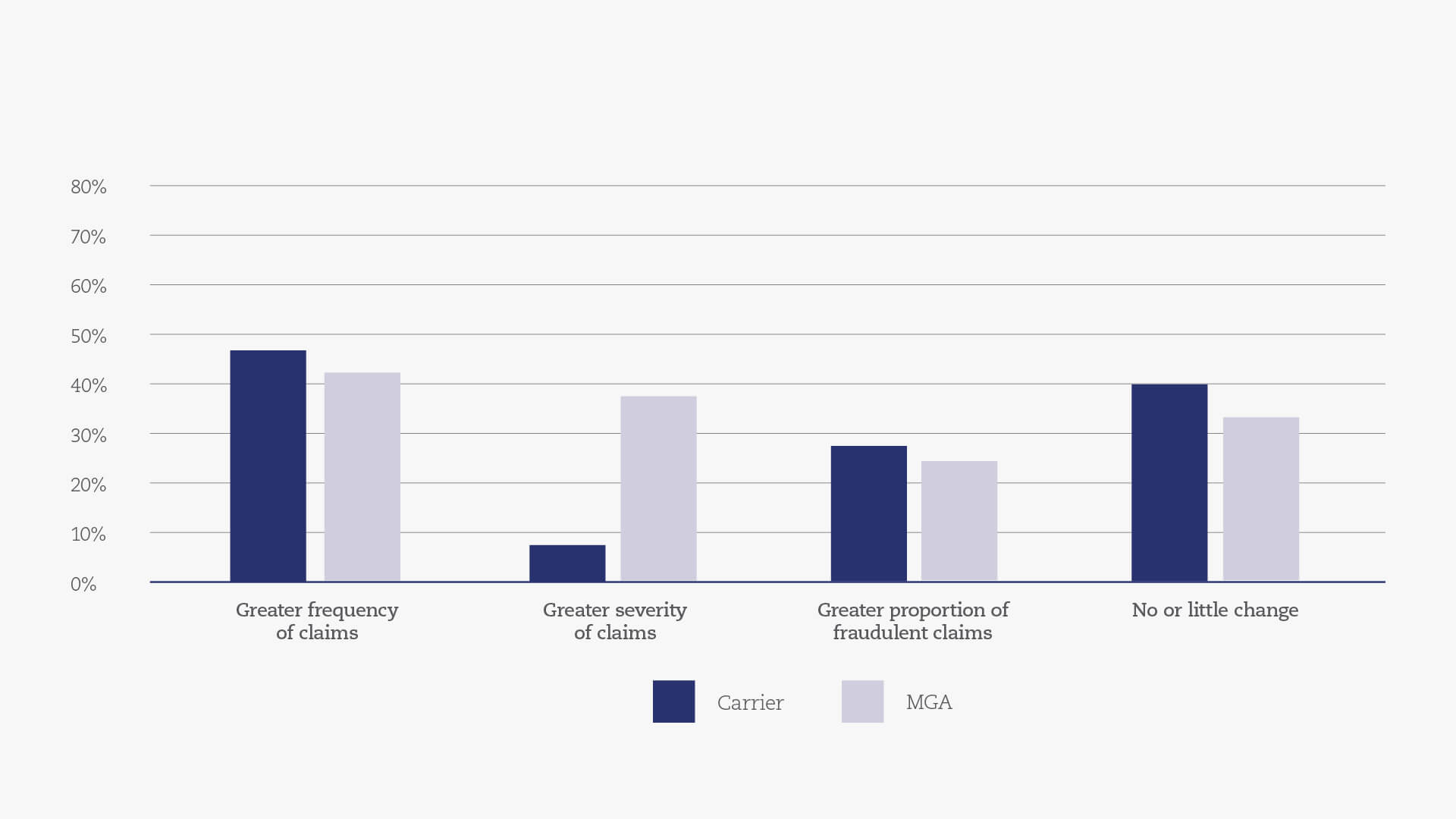

Our data shows a clear consensus between carriers and MGAs that claims frequency and severity will rise in 2022, with MGAs in particular taking a strongly pessimistic view on claims severity. This discrepancy may reflect better modelling capability on the part of carriers who may have priced in risk more effectively than their MGA counterparts.

For the moment, motor and fleet claims remain depressed, but cyber and data claims have seen significant increases as the world has moved to conduct more business online.

Moving forward, Carriers and MGAs can expect to encounter challenges as they strive to deliver value for insureds, pay claims promptly and maintain rate adequacy.

Still, there is a conviction among both carriers and MGAs that the claims management process requires improvement – a finding evinced by 87% of carriers and 67% of MGAs.

Respondents to our survey point clearly to the areas where improvements can be made in order to drive improved claims performance. Clearer processes, especially where TPAs are involved and faster communications emerge as the two top priorities. There was also considerable support from all parties to consider automating processes around lower value claims, or delegating claims authority more fully.

How do you anticipate claims will evolve in 2022?

结束