How claims inflation is reshaping Casualty insurance risks

-

Insight Article 2024年11月7日 2024年11月7日

-

英国和欧洲

-

Economic insights

-

保险和再保险

We continue to observe the trend of claims inflation in the UK, which is having a significant impact across various business lines, particularly casualty insurance. This is driven by a variety of macro-economic conditions and industry-specific factors, and expected to continue exceeding CPI throughout 2025.

Last year, we reported that claims inflation was the single largest risk for general insurers. In January of this year, the Bank of England’s Prudential Regulation Authority described the issue as follows in its “dear [CEO] letter” outlining 2024’s insurance supervision priorities:

Some of that data suggests that claims inflation (i) peaked at 11-12% in 2023, and (ii) was experienced most acutely in the fields of personal lines motor and property damage liability. Whilst 2024 promises better news, and insurers have sought to mitigate its effects since by pricing in risk at the underwriting stage, the lag between policy inception and claims settlement suggests claims inflation is likely to remain an issue into 2025 and beyond.

The Bank of England - Monetary Policy Committee Minutes

Thursday 7th November 2024

Whilst the cost of care remains high, the Bank of England’s Monetary Policy Committee minutes (5) published on the 7th November revealed that “Annual growth in private sector regular average weekly earnings had fallen back significantly since mid-2023, but had remained relatively strong at 4.8% in the three months to August” suggesting underlying conditions could continue to adversely affect the limited supply of skilled labour.

In a further example of claims inflation, the Personal Injuries (NHS Charges) (Amounts) (Amendment) (No. 2) Regulations 2024 were recently published, entering force in England & Wales for injuries occurring on or after 1 October 2024. They uplift the sums payable by insurers under the Injury Costs Recovery (ICR) scheme in Autumn – in addition to the routine Spring uplift – for the second time in as many years with the latest uplift estimated to generate an additional £4.9m. The Explanatory Memorandum also confirms that, from October 2024, “… the routine annual [i.e. not bi-annual] ICR tariff uplift will occur in October, rather than April, as this will allow the uplift to fully reflect the impact of NHS pay settlements inflation".

Read our insight on the First ever in-year increase in recoverable NHS charges here >

Read our Care Cost Market report here >

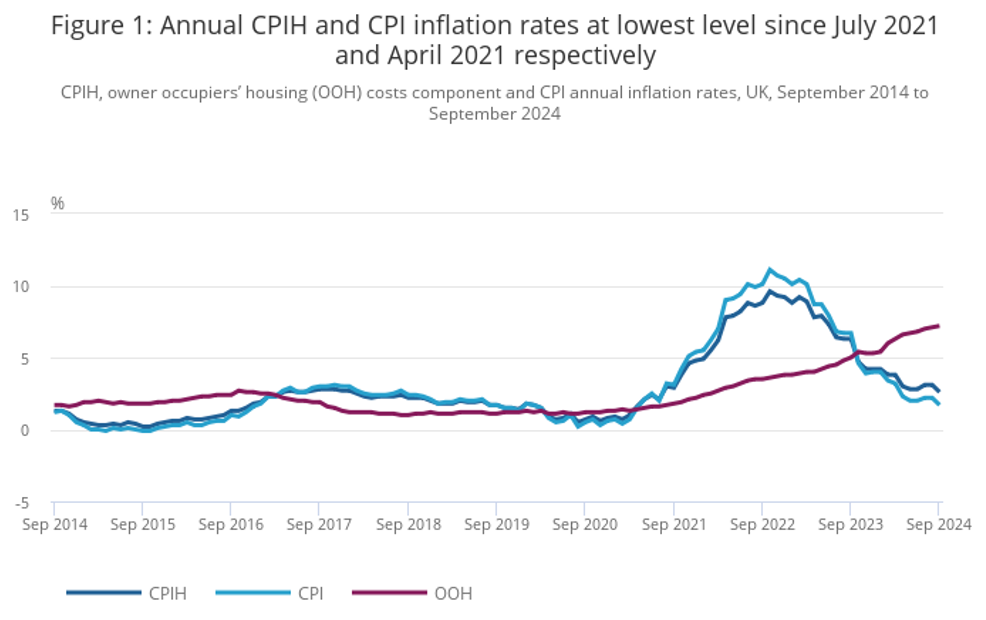

However, to conclude with perhaps better news, the ONS reports that the 12-month rate of CPI fell to 1.7% in September, down from 6.8% in September 2023 (6), suggesting inflationary pressures should continue to ease in 2025.

Source: Consumer price inflation from the Office for National Statistics (6)

The mitigations we discussed for Employers’ & Public Liability claims, which emphasise the value of educating customers about preventing occurrences in the first instance via effective risk management processes and assessments, apply equally to other lines of business such as Property Damage.

Business Intelligence tools that inform insurers about likely claims values can support better handling strategies, for example, to ensure liability is not being wrongly conceded on economic grounds.

The early intervention advocated in Motor and Credit Hire remains key, with realistic offers being recommended in appropriate cases to moderate lifecycles and indemnity spend.

Even prior to instructing lawyers, insurers’ own interventions – by offering to supply replacement chattels on a temporary or permanent basis – can mitigate certain losses, further suppressing claims inflation.

As for nefarious claims, our Fraud practice continues to deploy, and to recommend to clients, the use of an ever increasing pool of holistic datasets to track new behaviours across the entire claims process, and across a range of lines, to root out such activity.

Finally, when dealing with those unavoidable disputes resulting in litigation, selecting the right expert witnesses to inform handling strategies remains as vital as ever, whether for Complex Injury & Large Loss bodily injury claims or others. The enhanced cost of those reports represents another stark source of claims inflation, which means compensators dealing with lower value claims may wish to (re)consider whether a claim’s value warrants that additional expense.

Reach out to a member of our team below to explore these issues further.

结束

Deep-dive Pillar Reports

Claims inflation: Employers' & Public Liability

Claims inflation: Motor

Claims inflation: Fraud

Claims inflation: Credit Hire

Claims inflation: Catastrophic Injury & Large Loss

Claims inflation: Property Damage

Casualty claims inflation: The biggest claims risk for insurers?

Read MorePersonal Injury Discount Rate Hub

Read MoreReference Index

[1] Dear Chief Actuary Letter - June 2023

[2] Severity in the Official Injury Claims (OIC) Portal – which largely regulates tariff-based awards – remains stable.

[3] Recently applied in BRS v Gadd [2024] EWHC 1403 (KB)

[4] The Bank of England’s Letter from the Governor to the Chancellor on CPI Inflation - March 2024 (bankofengland.co.uk)

[6] The Office for National Statistics (ONS) consumer price inflation (CPI) bulletin, released 16 October 2024, ONS website, statistical bulletin, Consumer price inflation, UK: October 2024