À propos du rapport

Produit

18 septembre 2024

Écrit par:

Sujets

Réformes réglementaires

Cliquez sur chaque termes pour accéder aux articles correspondants

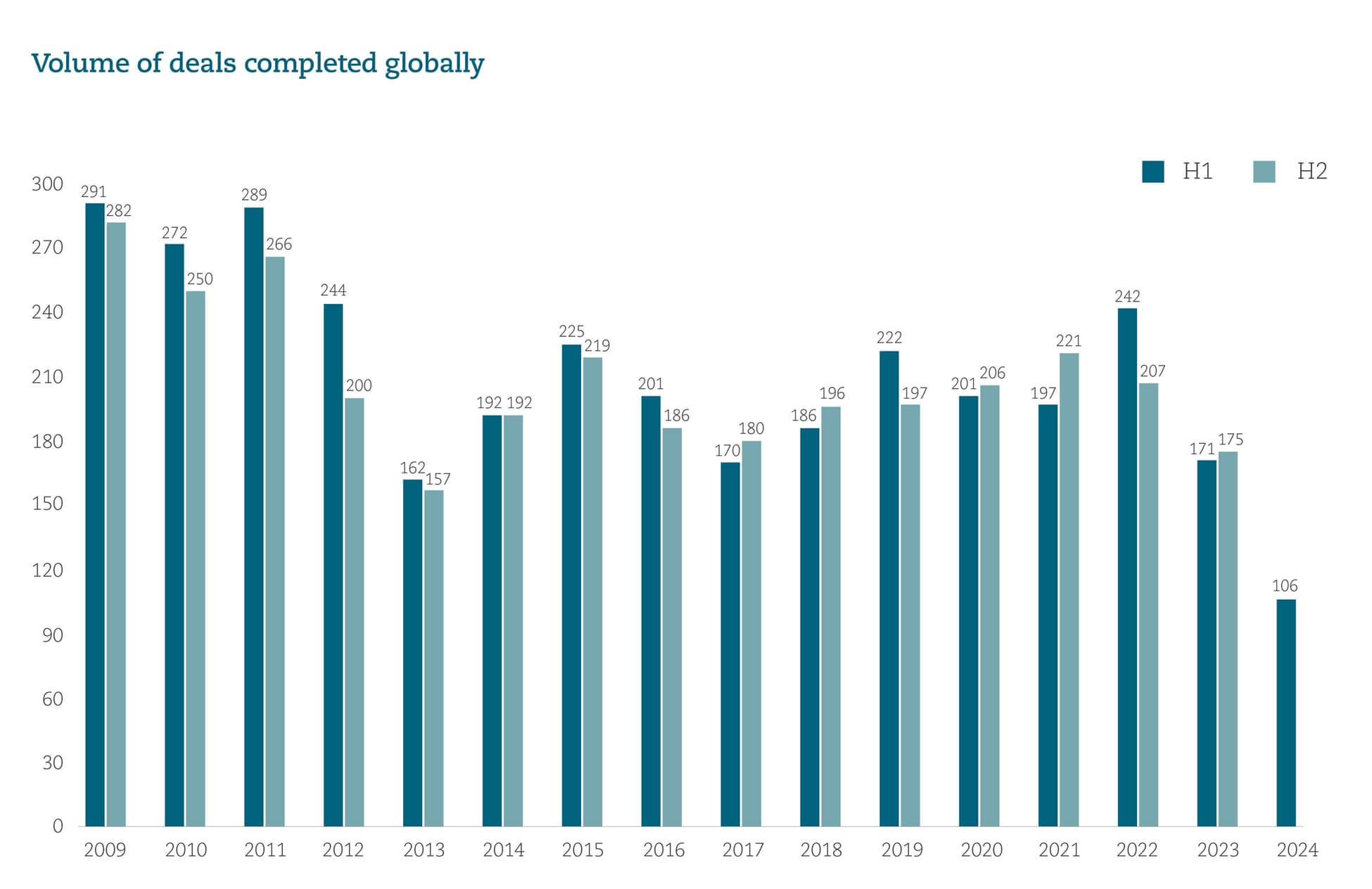

On a global scale, M&A activity remains marked by caution, much like in 2023. Buyers are more selective, prioritising deals that align strategically and culturally to avoid buyer remorse, while sellers are holding out for better offers amid more favourable market conditions. As we near the end of a period characterised by acute political uncertainty, high interest rates, and rampant inflation, stronger and more confident buyers may find themselves well-positioned to capitalise on opportunities from sellers who can no longer afford to wait.

At the start of the year, we identified five drivers of M&A activity to watch in 2024. In this report, we look at how the insurance M&A activity has progressed year-to-date.

Although 2024 hasn't been a standout year so far, a confluence of factors could shift the current momentum. Several growth drivers identified earlier in February have shown progress, and new dynamics are now at play. A global perspective often overlooks the nuances and variations across regions. While developed markets in the US and Europe are still waiting for more favourable conditions, the Middle East, fuelled by increased liquidity and regional optimism, has experienced heightened activity. Meanwhile, in Asia, Japanese industry leaders are expanding their influence through a series of strategic acquisitions, strengthening their regional presence.

Produit

18 septembre 2024

Écrit par:

Sujets

Réformes réglementaires

Produit

18 septembre 2024

Écrit par:

Sujets

Réformes réglementaires

I think that insurance M&A, for the remainder of 2024 and into 2025, will likely be driven by volume rather than the number of deals. And, as we’ve seen by Zurich’s recent acquisition of AIG’s travel insurance business, such deals will focus on specific niches covering multiple jurisdictions.

Eva-Maria Barbosa, Partner, Munich

M&A activity in the UK market remained low in the first half of 2024, following a strong 2023 with over 230 deals, largely driven by private equity and focused on brokers and intermediaries. However, private equity interest has waned in 2024, becoming more selective. Speculation now centres on larger UK carriers as takeover targets for foreign investors attracted by strong performance and low valuations. If activity picks up in the second half, bolt-on and niche acquisitions are expected to dominate. MGAs remain attractive due to their specialised expertise, but limited opportunities may lead to bidding wars.

MGAs have really shown their value in this market, which makes them attractive targets for would-be acquirers looking to bolt-on niche expertise and support growth. It allows buyers to acquire modern technology to underwrite and settle claims that they often don’t have.

Andrew Lucas, Partner, London

Brexit has reshaped the European insurance market, with more business staying on the continent. While global challenges have slowed carrier acquisitions, lower interest rates, political stability, and the EU mobility directive are set to boost cross-border M&A activity by simplifying multi-country deals. Generali’s recent acquisition of Liberty Mutual’s operations exemplifies this trend, though regulatory scrutiny, especially around private equity in life insurance, remains high. The European run-off market is also active, driven by economic pressures and capital constraints.

As political and economic uncertainty reduces and the new regulation is implemented, it becomes easier to embark on Europe-wide deals. While the total number of transactions may not increase dramatically, at least in the short term, we are increasingly likely to see deals involving multiple jurisdictions, with carriers looking to take on books or businesses which span 8-10 countries in one swoop. Some of the major carriers are now on the lookout for deals that will give them significant new premium.

Eva Maria Barbosa, Partner, Munich

The US and Canada took the lead for insurance underwriting deals in the first half of 2024, with 40 transactions, including Brookfield Reinsurance’s $3.6 billion acquisition of American Equity Investment Life (AEL), the largest deal worldwide. Other significant deals include KKR’s completion of its stake in Global Atlantic Financial Group and Prosperity Life’s $1.9 billion acquisition of National Western. Despite these major deals, North American M&A activity remains subdued, with transactions resulting from gradual, long-term investments. Optimism for renewed activity may rise post-election, with a stabilising economic environment potentially boosting deals in late 2024 and into 2025.

Some factors that might encourage M&A activity through 2024, if they develop favourably, are lower interest rates, lower inflation, implementation of insurtech for a better customer experience, and consolidation of operations to take advantage of economies of scale. The shedding of non-core lines of business is likely to be a feature too. All of these have a rosy outlook for the insurance industry in 2024.

Mark Voses, Partner, New York

Global players have continued to consolidate their positions across multiple geographies. HDI’s acquisition of Liberty Seguros in Chile, Colombia, and Ecuador this year, follows their takeover of Liberty’s Brazilian operations at the end of 2023. Combined, these acquisitions have significantly strengthened HDI’s presence across the continent. It is now the leading P&C carrier in Chile, number two by revenue in Brazil and a significant player in Colombia and Ecuador.

The Middle East's insurance market continues its five-year trend of consolidation, with local carriers expanding regionally to specialise on growth opportunities, despite a complex, fragmented landscape without passporting. Regional options for scaling are limited, but local players are gradually growing, while many international insurers are re-evaluating their direct presence. Notable deals include Abu Dhabi National Insurance Company’s acquisition of a 51% stake in Allianz Saudi Fransi Cooperative Insurance Company, marking ADNIC’s first expansion outside the Emirates. Enhanced regulations are driving consolidation and growth, while international specialty carriers are targeting niche areas like reinsurance and trade credit through smaller operations in hubs like DIFC and ADGM.

We're seeing the internationals increasingly focus on a reinsurance strategy. So rather than trying to set up direct operations in multiple markets which are quite hard to scale, and can be quite capital intensive, what we're seeing is players basically looking to play in the market as a reinsurer and access that way.

Peter Hodgins, Partner, Dubai

The M&A market has been comparatively resilient in 2024. While deal activity is down year-on-year, this decline has been less pronounced than in the US or Europe. There have also been several large scale, cross border transactions, bucking the trend seen in other regions. The major Japanese carriers continue to expand their regional footprints, with Sumitomo Life’s acquisition of Singapore Life, representing the largest international deal in the region. Across APAC, a number of established carriers continued to acquire new operations in the region’s developing economies with 40% of the deals this year being cross border.

Across Asia, the health and life sector remains the main driver of insurance M&A, with market players looking to expand distribution, gain scale and extend their reach across value chain. Contrary to global trends showing dampened M&A activity in the P&C market, the APAC region has proved to be resilient with solid M&A activity. In the Insurtech space, we also see insurers re-assessing their strategies in order to strengthen their positions in the market. APAC insurers are demonstrating greater interest in technology, which is in line with the global trends.

Joyce Chan, Partner, Hong Kong

South Africa's M&A activity has slowed significantly due to high inflation, rising interest rates, and sluggish economic growth. The situation is worsened by energy issues and political uncertainty ahead of the May elections. The country’s grey listing by the Financial Action Task Force in February 2023 over money laundering concerns has further deterred investors. Additionally, increased regulatory scrutiny has introduced new merger conditions, such as local ownership requirements and sustainability mandates. Despite these challenges, there has been a rise in M&A inquiries, especially in the broker and MGA markets, hinting at potential recovery.

The South African financial service industry is well-developed and financially sound, and although investments have been slow, the major players are actively looking for opportunities. There are also a number of major large multinationals that hold a long-term view of South Africa, and they will continue to make acquisitions. While we may not see a dramatic increase in M&A activity over the next 12 months, there will definitely be an uptick given the financial soundness of the South African insurance and financial service providers in general. I expect that the target area will be to grow distribution. And the easiest way to achieve that is by acquisitions. There's a number of large brokerages in the market, as well as underwriting managers, and I expect acquisitions in that space. A further growth driver is in the embedded insurance space as technology providers are expanding their integration capabilities and would be looking for partnerships with insurers.

Ernie Van Der Vyver, Partner, Johannesburg

Fin