Insurance Growth Report 2022 – Mid-year update

À propos du rapport

Produit

27 février 2023

Écrit par:

Temps de lecture

10

Sujets

Changements climatiques

TéléchargerCliquez sur chaque termes pour accéder aux articles correspondants

1. Introduction

In an increasingly uncertain world, insurers, like all businesses need to be adept at assessing the challenges and navigating risks across a spectrum of issues. This report looks back at what drove insurers’ growth activity last year and pulls out key trends likely to impact them in 2023 as they seek to grow in this most complex of environments.

Insurers received a boost from hardening property-casualty rates in 2022, but the growth outlook for the sector in the year ahead appears to be a mixed bag.

The effects of the on-going Russia-Ukraine conflict on global insurance business are still being felt – from greater complexity around war and cyber risk exposures, to increased costs of doing business from inflated energy and commodity prices.

Meanwhile, continuing economic uncertainty has muted investor appetite for start-ups, particularly in the insurtech space, and has started to dampen enthusiasm for M&A transactions, impacting corporate business for investment banks and law firms.

However, the MGA space remains buoyant, particularly in London and Europe. China is opening up for cross-border business. Big-ticket M&A transactions are expected to pick up. And the liberalisation of certain regulations is attracting investment to markets across the EMEA region.

To read the full report, click the download button.

Produit

27 février 2023

Écrit par:

Temps de lecture

10 mins

Sujets

Changements climatiques

TéléchargerProduit

27 février 2023

Écrit par:

Temps de lecture

10

Sujets

Changements climatiques

TéléchargerWhile ‘mega-deals’ in the insurance M&A market – those valued in excess of USD 1 billion – have struggled to get off the start line in the past 12 months, there is an expectation that this year could see the return of big M&A transactions.

M&A rose to a three-year peak in the first half of 2022, before becoming progressively quieter. However, M&A lawyers are expecting a two-speed 2023. Small to medium-sized enterprises will continue to be wary of transactions as they wait for the current market uncertainty to subside.

In contrast, large global insurance businesses seem undeterred by market conditions. Their focus is on consolidation in preference to limited organic growth options, so they are actively seeking merger and acquisition opportunities. Private equity funds have largely been absent from the insurance market over the past year but have maintained their focus on larger M&A targets in anticipation of potential opportunities.

Heavy regulatory activity is proving burdensome for insurance carriers, impacting their capacity for organic growth. Consumer protection laws are making it harder to do the same volumes of business across multiple jurisdictions, with GDPR laws a common area of focus.

Globally, ESG is expected to be a major focus for regulators this year, with a particular emphasis on cracking down on ‘greenwashing’ and ‘social washing’ as organisations seek to market their ESG credentials.

The MGA model is still proving popular in the London and Lloyd’s market, especially where insurers want to penetrate further into markets where they lack the appropriate depth or breadth of underwriting expertise.

And in Europe, some MGAs appear to be entering a new growth stage, either through bringing original products to market, or, in the case of one well-established firm, having transitioned into becoming a full-stack risk carrier, with licensed insurer status. Other MGAs harbour similar ambitions.

While technology plays a continuing role in enabling growth in the insurance sector – automating elements of underwriting and claims processes, driving parametric coverage, and opening up new distribution channels – investment in insurtech companies has stagnated.

Against this broadly slow growth background, embedded insurance offers a glimmer of hope. Solutions tailored to online retail sales, travel-related bookings, and other online services are likely to increase discretionary insurance purchases.

While the insurance market is finding more applications for blockchain technology, particularly for parametric coverage, the cryptocurrency market that it underpins has yet to make much impact on the sector insurers.

In the insurance space, litigation around employment contracts has been more focused in recent years on the movement of individuals and teams to rival companies in so-called ‘poaching’ disputes.

As companies weigh up the pros and cons of organic growth versus M&A, against a backdrop of continued economic turmoil more movement of individual talent and teams seems likely, raising the prospect of contentious claims.

If 2023 does see a return to major M&A deals in the insurance market, there is likely to be a sharper focus by acquirors and merger partners on the best approach to combining differing company cultures.

Businesses increasingly need to consider whether the culture of a combined entity is consistent with ESG strategies, DE&I frameworks, employee wellbeing and mental health considerations, and the need to modernise working practices. They must also be aware of increased regulatory scrutiny of their complaints procedures, alongside a growing willingness among employees to pursue complaints.

While deal activity was up on all regions in 2022, underlying trends point to mixed investor sentiment.

A combination of pent-up demand, healthy levels of capital ready to deploy and a favourable investment environment has seen deal-makers in the Americas and Europe drive higher levels of M&A in the last couple of years than were evident at the beginning of the decade.

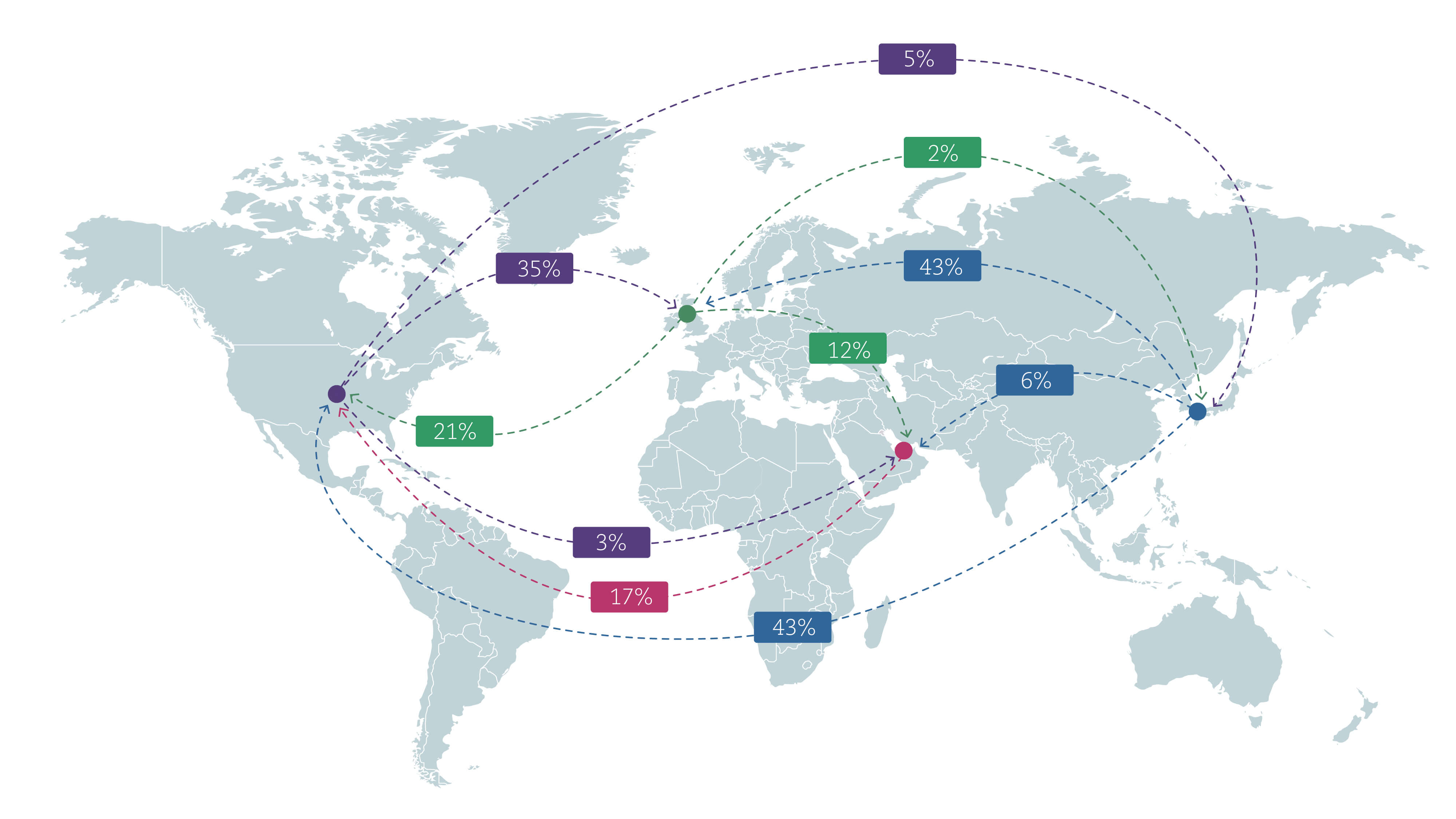

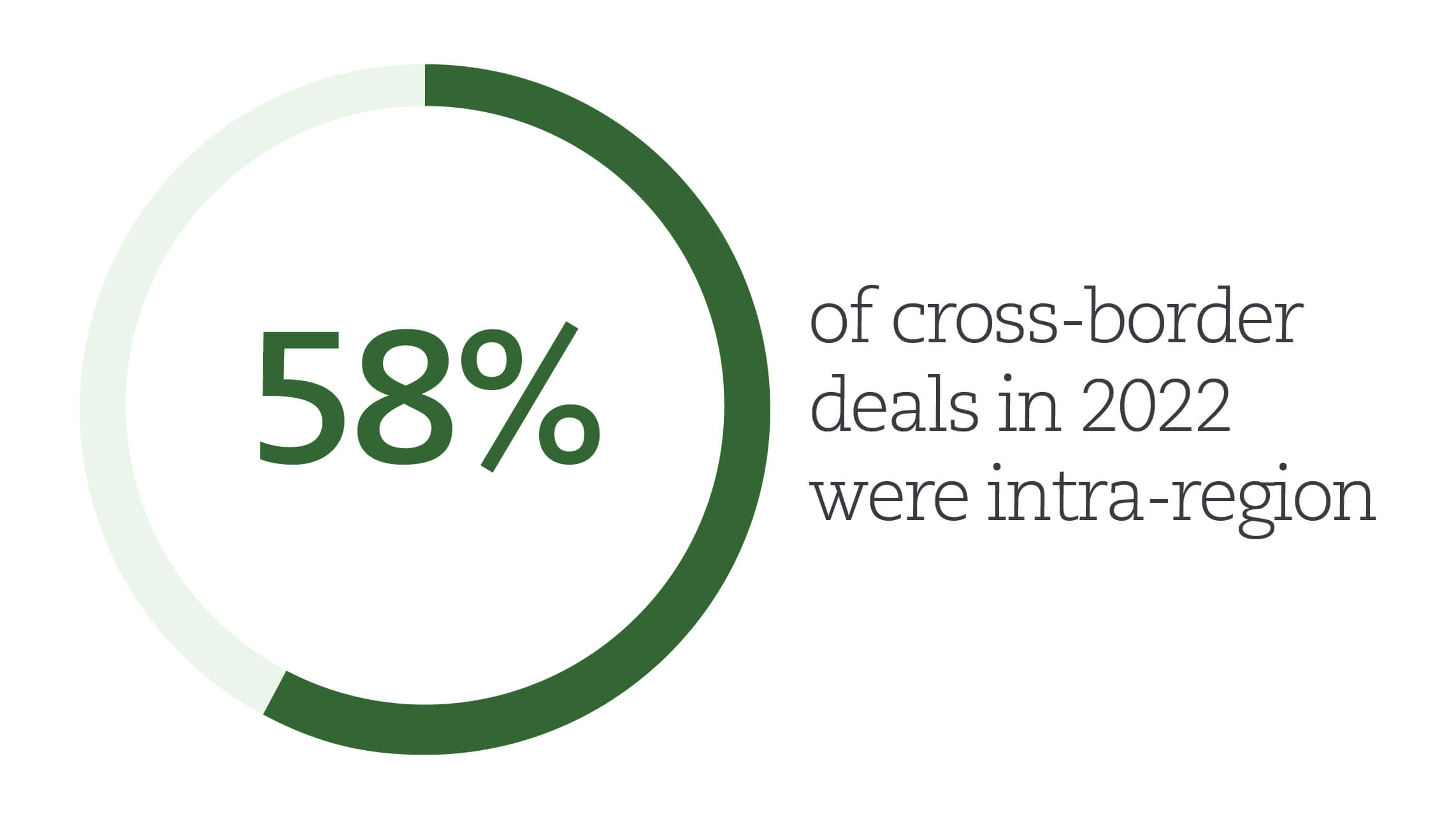

The volume of mergers and acquisitions involving foreign targets was broadly flat in 2022. Cross-border deals accounted for 21% of the global total, compared to 22% the previous year.

As illustrated by this report, while political and economic pressures continue to challenge the M&A market, there remain growth opportunities for those able to navigate the risks successfully.

At Clyde & Co, we’re here to help achieve your commercial objectives. Our longstanding insurance sector experience means we see these challenges and opportunities differently. With over 65 Corporate & Advisory specialists around the world, Clyde & Co can offer you guidance and advice across the corporate landscape.

From financing, regulatory and governance, to mergers and acquisitions, restructuring, IP, technology, employment and equity portfolio management, you can trust our international network to provide bespoke, commercial and practical advice, wherever you want to do business.

Fin