Changements climatiques

COP26 Summary report

Cliquez sur chaque termes pour accéder aux articles correspondants

Introduction

Biodiversity risk is increasingly going to be on the corporate radar as part of ongoing work to mitigate climate change risk (and support nature-based solutions) and broader initiatives on ESG. At the same time, accounting and reporting standards for biodiversity-related risks and impacts are taking shape.

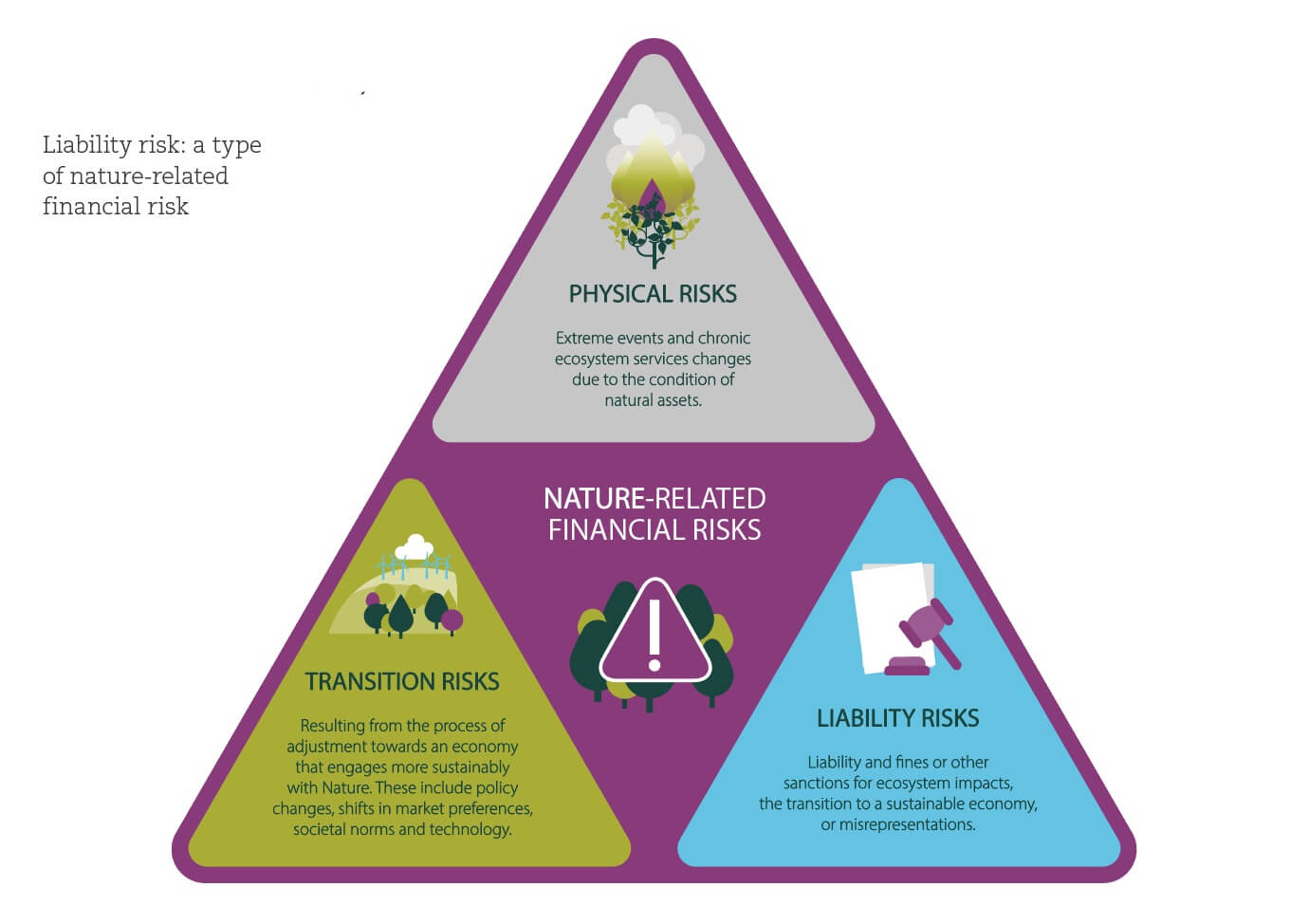

As a result of increased scrutiny of both the dependencies and impacts that companies have on biodiversity and the increasing harms caused by biodiversity loss, we will begin to see an uptick in litigation risk. Added to this picture is the growing use of data from remote sensing and in supply chain management which will permit a better understanding of where biodiversity loss is occurring and who may be responsible.

Cases may be brought for the direct impact of companies on ecosystems or particular species, or for the deprivation of related ecosystem services to communities or other companies that depend on them. Liability risks can also arise from a failure to adequately or faithfully report on biodiversity-related risks, or misrepresenting nature-positive credentials.

Importantly, the advent of biodiversity litigation risk comes at a time of (1) greatly enhanced value chain due diligence requirements, and (2) courts’ preparedness to recognise the rights of nature as a legal person alongside humans and corporations.

Against this backdrop, our Climate Risk and Resilience team, together with the Global Resilience Partnership, has produced a joint report on biodiversity liability and value chain risk.

Produit

15 mars 2022

Écrit par:

Temps de lecture

7 mins

Sujets

Changements climatiques

TéléchargerProduit

15 mars 2022

Écrit par:

Temps de lecture

7

Sujets

Changements climatiques

TéléchargerBusiness leaders and boards will face a raft of new responsibilities.

What is the problem?

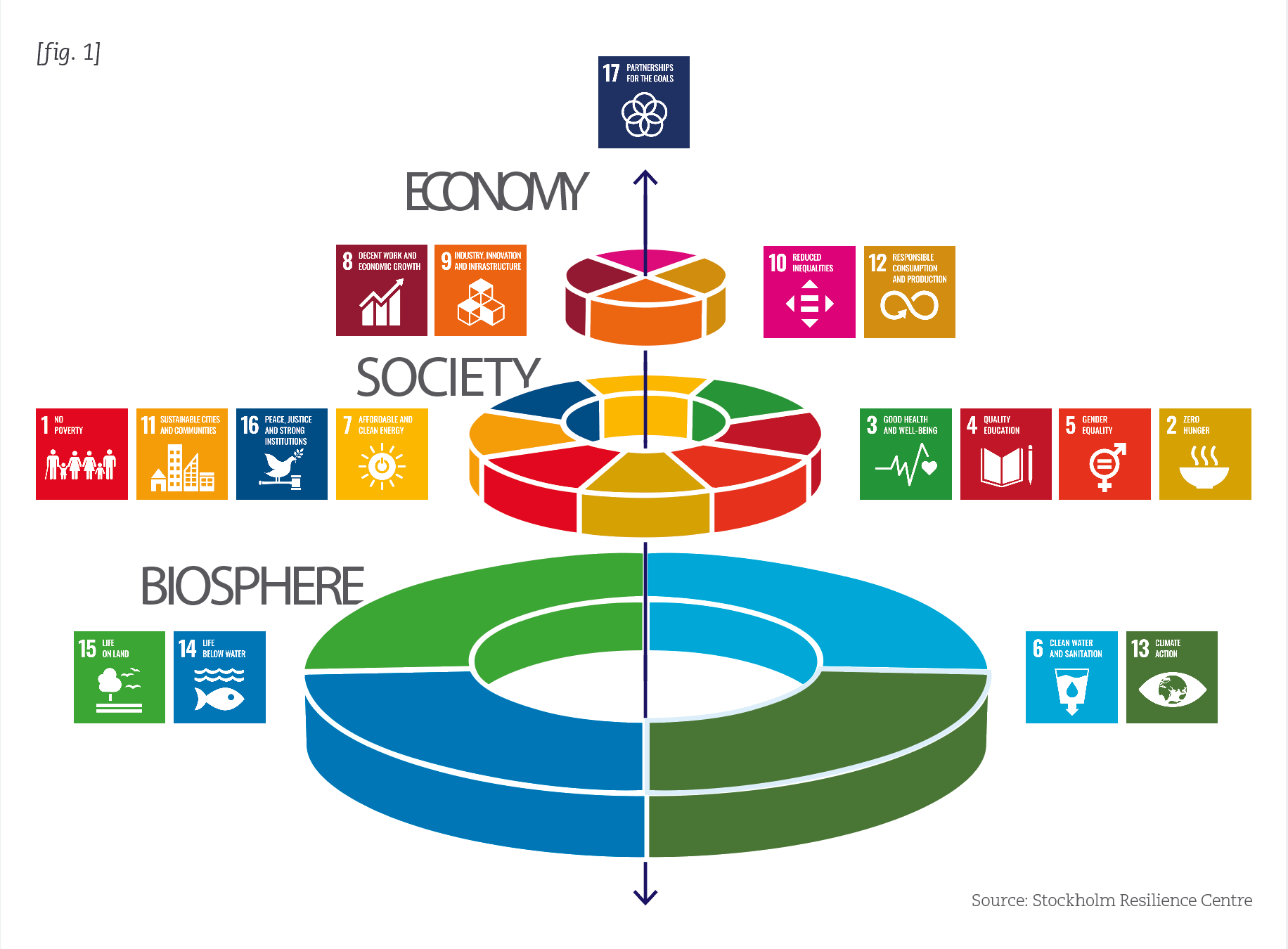

Climate change is just one of the world’s planetary boundaries. Human civilisation also depends on a healthy biosphere – the thin layer of interconnected ecosystems that sustain life on Earth. We depend on biodiversity to pollinate crops for the food we eat, to clean water and air, for many of the products we consume and our physical, mental, and spiritual well-being. Nature has been providing these “ecosystem services” free of charge with economic models not properly accounting for nature’s contributions to people, or for the true costs of pollution and environmental degradation.

There is a movement towards integrating biodiversity risk into mainstream economic thinking and financial and corporate planning, similar to the trajectory of climate change risk. Stakeholder interest is growing, with government initiatives now bolstered by financial market pledges.

Shareholders will soon be scrutinising biodiversity in investee companies, and regulators will be looking carefully at the environmental impacts of companies and expecting due diligence on subsidiaries and within value chains.

The biodiversity crisis is upon us.

Accounting for biodiversity loss

Biodiversity describes the enormous variety of life on Earth and can refer to every living thing in one region or ecosystem, including plants, bacteria, animals and humans.

Human well-being, culture and development depend on a resilient biosphere - the thin layer of ecosystems and biodiversity on planet Earth that supply essential ecosystem services. Ecosystems and biodiversity are not something external to the economy or human societies, but rather the very foundation of civilisation.

Human actions have driven at least 680 vertebrate species to extinction since 1500. The global rate of species extinction in the 21st century is tens to hundreds of times higher than the natural rate over the past ten million years.

Biodiversity loss, too, has the potential to cause severe disruption to businesses and value chains.

Value chain risk and biodiversity loss

Global trade and the integration of a globalised economic system has been an overarching narrative of human development over the last two centuries. Across the world today, one-fourth of global production is exported. Value chains connect continents, countries and companies with multinational corporations involved in over 80% of global trade. Even during the pandemic-stricken year of 2020, international shipping moved 10.65 billion tons of cargo across the globe.

Yet several recent crises have highlighted the fragility of the global value chain system. Value chain risk and resilience is front of mind for multinationals, financial institutions and, increasingly, the general public.

Biodiversity loss, too, has the potential to cause severe disruption to businesses and value chains. The World Wildlife Fund (WWF) has compiled a framework for nature-related risks to business, identifying risks cited in corporate reporting, disclosure frameworks and risk analysis tools as a proxy for the materiality of nature-related risks across sectors.

|

Risk type |

Threat |

Consequences |

|

Physical Risks |

Acute events; damage from natural/ man-made hazards Biodiversity loss and decreasing species richness Scarcity of water Availability, reliability, and security of energy Habitat loss Air pollution Water pollution |

Disruptions to business operations Labour shortages |

|

Regulatory and Legal Risks |

Litigation, damages, and/or compensation Pricing or other regulations for emissions (greenhouse gases (GHG)*/other) Restrictions on land and ES access Air pollution regulation Non-hazardous waste management Soil pollution regulation Resource quotas for ES use Unsustainable practices Changing liability regimes Hazardous waste management Water pollution regulation Changes in disclosure requirements |

Unexpected costs of compliance/fines for noncompliance Stranded assets |

|

Market Risk |

Changing consumer preferences Inability to attract co-financiers due to uncertainty Purchaser requirements |

Changes in the cost and availability of resources |

|

Reputational Risk |

Negative press coverage Divestment or other stakeholder campaigns Impacts on World Heritage Sites or protected areas Impacts on species on IUCN Red List |

Lost sales due to negative perceptions of the institution |

There are four major developments that look set to rapidly shift the dial on the materiality of biodiversity risk for corporates.

Biodiversity law is the branch of law that “seeks to regulate the use, management, conservation and fair and equitable distribution of the benefits arising from the use of the components of biodiversity and ecosystems, with the aim of helping to fulfil the needs and aspirations of both present and future generations”.

The international convention on biodiversity Biodiversity is protected internationally under the Convention on Biological Diversity (CBD), the international legal instrument for “the conservation of biological diversity, the sustainable use of its components and the fair and equitable sharing of the benefits arising out of the utilisation of genetic resources”

The CBD is just one of the many international conventions that govern biodiversity

Biodiversity is protected at the national level through a diverse framework of law and regulation. Some countries have enshrined biodiversity protection in their constitutions.

Other countries have a robust environmental protection framework.

In the UK, biodiversity protections are embedded in a range of legal instruments including the Environment Act 2021 and the regulations which will make its provisions operative, the Natural Environment and Rural Communities Act 2006, the National Planning Policy Framework (NPPF), the Conservation of Habitats and Species Regulations 2010, and the Wildlife and Countryside Act 1981 (as amended).

There are four major developments that look set to rapidly shift the dial on the materiality of biodiversity risk for corporates:

European Union Corporate Due Diligence law

The regulation and compliance burden in this space is set to increase, rapidly.

The threat of litigation for climate change and other environmental harms is evolving rapidly.

In view of the urgency of the climate crisis and the perceived slowness of governments to act, citizens have taken to the courts with high profile support and serious funding.

In the years since the 2015 Paris Agreement, the number of climate cases globally has more than doubled, to over 2,000 in 39 jurisdictions. These cases are setting new precedents and inspiring other actors to use the law as a tool in the global fight to mitigate and adapt to climate change.

Forward-looking companies will begin their journey now.

Mitigating biodiversity risk: action plan

Any company operating in or with important relationships in the EU or other jurisdictions where mandatory due diligence standards are arising, should ensure that they understand the changing regulatory landscape, prepare for incoming legislation, and adapt business plans to account for the new risk landscape, including the emergence of foreseeable biodiversity liability risk.

Forward-looking companies will begin their journey now, preparing for eventual compliance as and when nature-related disclosure standards solidify and mandatory due diligence laws come into effect.

With special thanks to:

Catriona Campbell, Alisha Kumar, Jayde Pulford, Amy Ross, Isabelle Merchat, Chidozie Ajike Kachi-Agwu, Ana Favretto, Alysha Patel and William Ferris, Emily Caldwell, Alessandro Ferrari

Fin