At the end of 2024, another round of RES auctions allocated support to solar and wind projects in Poland

-

Bulletin 3 février 2025 3 février 2025

-

Royaume-Uni et Europe

-

Réformes réglementaires

-

Énergie, commerce et droit maritime

In December 2024, the President of the Energy Regulatory Office carried out 7 auctions allocating support to several types of RES. All auctions were dedicated to new projects, i.e. those that will generate energy for the first time after the auction date.

Out of 7 auctions only 2 were resolved successfully: one for (onshore) wind and solar projects with capacity of above 1 MW ("Large Projects") and one for (onshore) wind and solar projects with capacity up to 1 MW ("Small Projects "). The remaining auctions remained unresolved failing to meet the statutory minimum of 3 valid bids.

Details of the budgets of each auction were presented in our previous alert, which you can read here.

Auction for Large Projects

According to disclosed data, 105 producers submitted 174 bids in the auction for Large Projects (all bids except two pertained to PV projects). Out of this pool, support was awarded to 128 projects owned by 82 producers. It appears that support was granted to 2 wind projects and 126 solar projects.

Successful projects will access ca. PLN 4.856 bn (out of an available budget of PLN 6.225 bn) supporting ca. 15 388 TWh (out of a budgeted volume of 21 750 TWh) in the form of a CfD settlement against the successful strike price (pay-as-bid). This translates to utilization of the budget (i.e. ration of support awarded compared to the full budget) of 78.01% in terms of funds and 70.75% in terms of MWh.

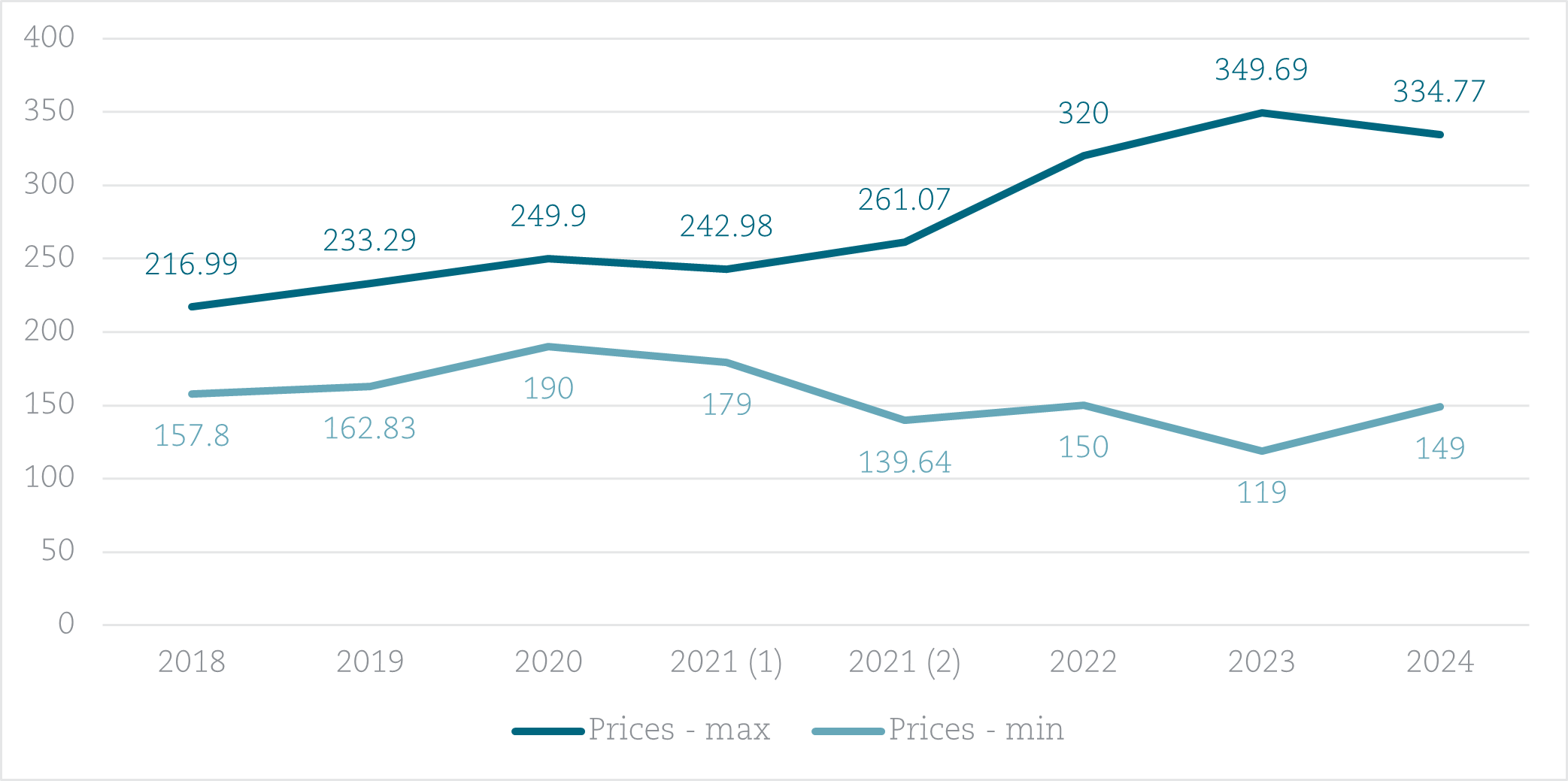

The lowest strike price offered in this auction was 149.00 PLN/MWh for wind projects and 244.80 PLN/MWh for PV projects. The highest accepted bid amounted to 175 PLN/MWh for wind and 334.77 PLN/MWh for PV.

The strike price range between 149.00 PLN/MWh and 334.77 PLN/MWh remains well below the bid cap prices for each respective technology (the so-called “reference prices” i.e. the highest price that a given installation can offer in the auction) set at 389 PLN/MWh for PV projects and 324 PLN/MWh for wind project. A summary of the highest and the lowest accepted bid over the last years is presented in Figure 1 below.

As a result of this auction, support was awarded to PV projects with a total capacity of 1 481 MW and wind projects with a total capacity of 90.8 MW.

Figure 1 – The highest and the lowest bids in auctions for Large Projects in auction 2018-2024

Auction for Small Projects

46 producers submitted 96 bids in the auction for Small Projects (all bids supporting PV projects). Out of this pool, support was awarded to 72 projects owned by 40 producers.

As a result of the auction, successful projects will enjoy the CfD based support up to ca. PLN 254.746 m (out of an available budget of ca. PLN 3 825 m) and 738 954 MWh (out of a budgeted volume of 11 250 000 MWh). This translates to utilization of the budget of just 6.66% in terms of funds and 6.57% in terms of MWh.

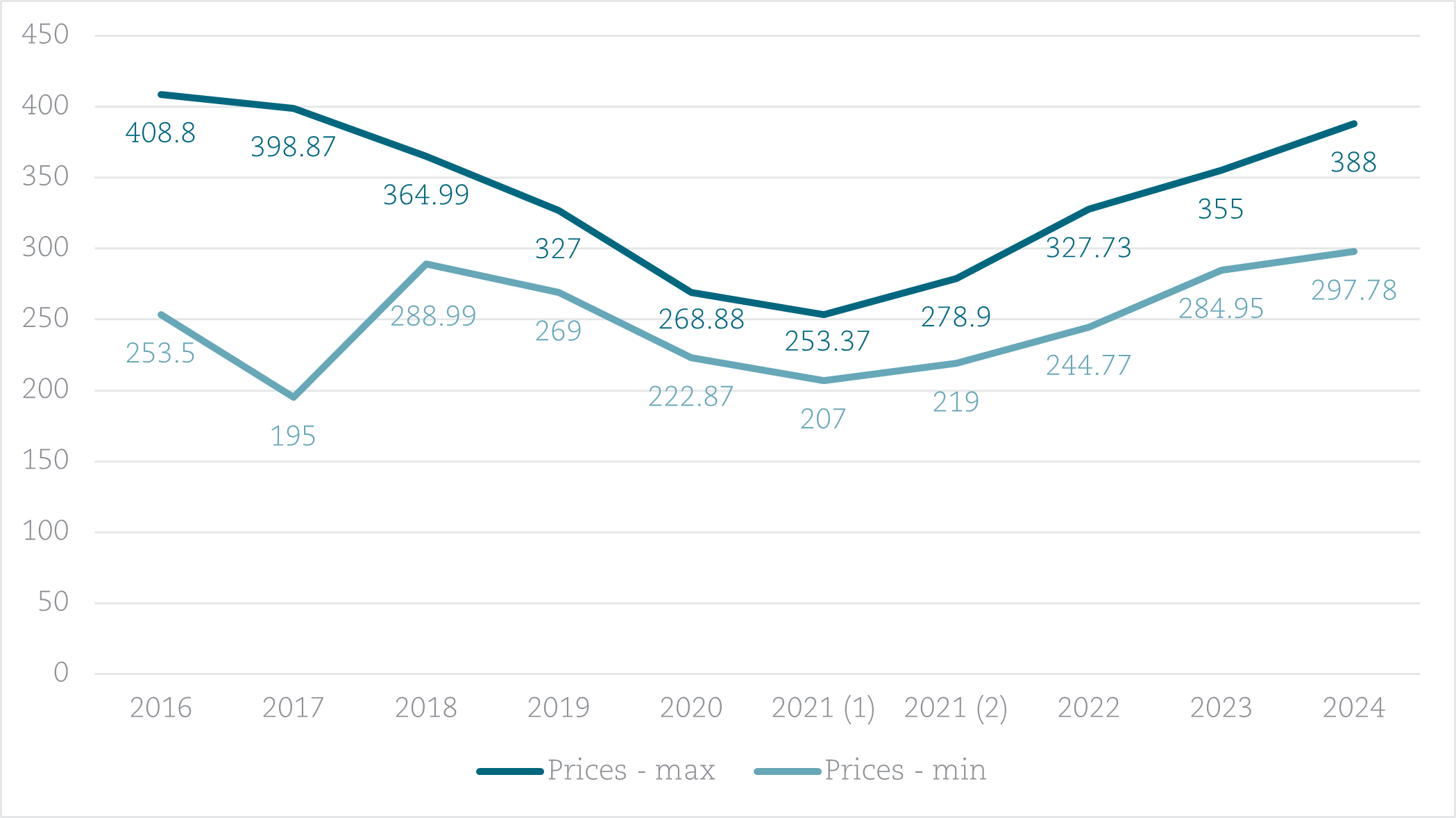

The lowest price offered in this auction amounted to 297.78 PLN/MWh and the highest accepted bid amounted to 388 PLN/MWh. This compares to a bid cap set at 414 PLN/MWh for PV projects. A summary of the highest and the lowest accepted bid over the last years is presented in Figure 2 below.

As a result of this auction, the support was awarded to solar projects with a total capacity of 67,2 MW.

Figure 2 – The highest and the lowest bids in auctions for Small Projects in auction 2016-2024

The key takeaway

2024 auctions results offer several takeaways.

Firstly, auctions for the Large Projects seem to be attractive again. In 2022 and 2023 the utilization of budget (in terms of MWh) was much lower (respectively 56.89% and 21.89% provided that budget in 2023 was the same as in 2024 and budget in 2022 was roughly half of budget from 2024). It remains to be seen whether this is an emerging trend or a one-off result.

Arguably, the increased interest in auctions may arise from: (i) a decrease of energy prices from the peak which occurred in 2022 (thus the auction’s strike prices may be again considered attractive); (ii) increased number of balancing related curtailments of PV energy on the market – the auction system provides for a certain protection in such cases.

Secondly, the number of Small Projects participating in the auctions is steadily falling from peak which occurred in 2020 (1618 bids were placed that year in a single auction). This likely confirms that the development of small (below 1 MW) PV projects was previously dictated by worse competition conditions in the Large Projects auction basket (wind projects consistently capturing a greater part of the available budgets). Once the conditions became more favorable for PV offering, investors interested in auction subsidies moved from Small Projects to utility scale PV installations.

The support in the Large Projects’ auctions is now mainly allocated to the PV projects. When the first auctions for Large Projects were announced, wind projects dominated (in 2018-2020). Since 2021, PV projects started capturing more support (in terms of supported MW of projects) and since 2023 the capacity of wind projects supported in auction is negligent (in 2023 the capacity of wind projects amounted to only to ca. 5% of all capacity awarded, in 2024 the wind amounts to 5.7% of the whole supported capacity).

This is likely due to small number of the wind project on the market – the development of the wind projects generally stopped between 2016 and 2023 due to regulatory reasons. Projects which existed before 2016 have secured support in the auctions which took place between 2018 and 2020 (wind projects of ca. 4.3 GW were awarded support in these three auctions), whereas new projects have not yet been developed to the stage when they can be put forward in the auction. The long overdue regulation improving onshore wind permitting conditions is still debated by the Government. Once enacted it is expected to generate another stream of wind projects. However, we deem it unlikely that this new pipeline would materially affect bidding conditions in the 2025 and possibly 2026 RES auctions.

Fin