U.S. Issues Proposed Rules Regulating U.S. Outbound Investments

-

Bulletin 27 juin 2024 27 juin 2024

-

Asie-Pacifique, Amérique du Nord

-

Vue sur l’économie

-

Droit des sociétés

On 21 June 2024, the United States Department of Treasury issued proposed regulations implementing “reverse CFIUS”, a mechanism by which the United States, for the first time, will regulate U.S. outbound investments to “countries of concern” in specified sectors.

The “reverse CFIUS” mechanism was established through the issuance of an Executive Order by President Biden on 9 August 2023, “Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern”. The 21 June 2024 proposed regulations, namely the Notice of Proposed Rulemaking (NPRM), further implement this executive order.

The NPRM do not represent binding rules, which will be issued following the U.S. Department of Treasury’s examination of public comments received pursuant to the NPRM, which are due by 4 August 2024.

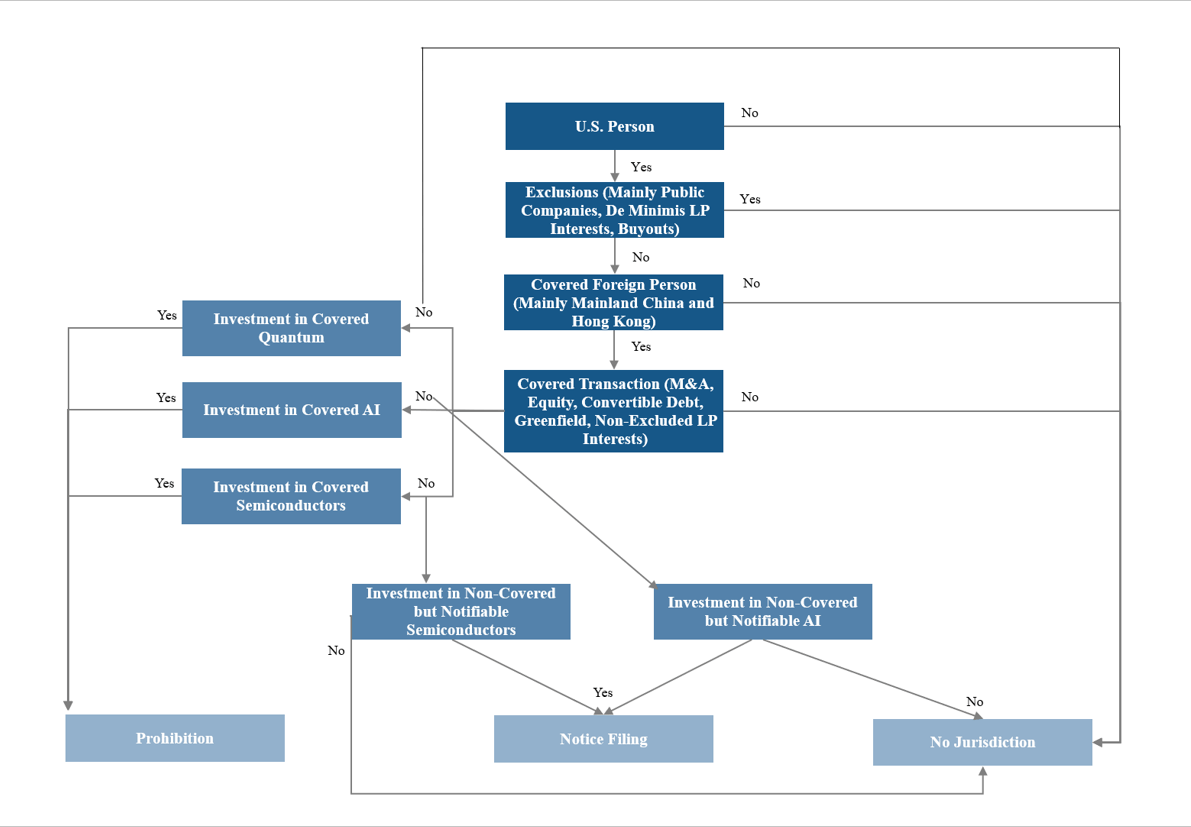

This note highlights the key points in the NPRM, which supplement or are different to the Advance Notice of Proposed Rulemaking (ANPRM) issued concurrent with the executive order. It will then highlight the key points of the “reverse CFIUS” regime. Appendix 1 sets forth a decision tree for the “reverse CFIUS” regime as currently constituted.

Key Points in the NPRM

Limited Partner Investments: The NPRM contains two alternatives for defining the de minimis exception for limited partner investments in investment funds who invest in prohibited sectors. The first would allow an exemption for so long as the U.S. limited partner’s fund commitments do not exceed 50% of the fund’s total commitments. The second would only allow an exemption if the U.S. investment is not more than US$1,000,000.

The practical market impact of the two alternatives could be profound. Many USD investment funds have arisen in the last decade, whose business model involved Chinese general partners raising U.S. funds that were then invested in PRC start-ups. This business model would effectively end were alternative two adopted, but may survive if alternative one is adopted as long as there is another reliable base of capital.

Of note, if U.S. investors are effectively no longer permitted to be exposed to the PRC’s technology ecosystem, including through limited partner investments in investment funds that invest in prohibited sectors, it could present new opportunities for non-U.S. investors who are not subject to these restrictions. Global investment funds, including those based in the U.K. and Europe, may consider special arrangements whereby their U.S. investors are hived off from PRC investments in prohibited sectors.

New AI Prohibitions: The NPRM expands, and more specifically sets forth the parameters for. prohibited investments in the PRC’s AI sector. Prohibitions would arise if the computing power used to train AI models exceeds a certain specified threshold. There are currently five proposed thresholds, one of which involves biological sequencing data.

This clarifies one of the most common questions arising from the ANPRM, which did not specify in detail what AI transactions would be prohibited, but rather only proposed a standard based on whether the use was primarily or exclusively tied to military applications.

Prohibition on Facilitation Transactions: The APRM prohibits U.S. persons from “knowingly directing” a transaction by a non-U.S. person that would be prohibited if that non-U.S. person was a U.S. person.

This prohibition may have anticipated practical market behaviour whereby U.S. persons, whether institutions such as venture capital and private equity funds, or U.S. citizens or permanent residents at those funds, would facilitate these transactions to be performed by non-U.S. persons, in exchange for financial advisory fees or other financial incentives. This addition speaks to the U.S. Treasury having a good understanding of market dynamics and how it was previously intertwined with involvement by U.S. persons. The fact that they seek to end this interdependence speaks volumes about the policy intent of “reverse CFIUS”, but as stated above, this will open opportunities to non-U.S. investors to fill the void.

Overview of Reverse CFIUS Currently Constituted

Appendix 1 sets forth a decision tree for the “reverse CFIUS” regime as currently constituted. There are four key definitions, along with parameters for prohibited and notifiable transactions. As presently constituted, a notifiable transaction does not involve a substantive review.

U.S. Person: “Reverse CFIUS” only can apply to U.S. persons, who are U.S. citizens, permanent residents, and U.S. entities.

Exclusions: Apart from the limited partner investment exclusion described above, the other primary exclusions are public company investments and buyouts. Accordingly, U.S. investment in public companies, even ones that engage in prohibited activities, is expressly allowed. U.S. investment that would result in an acquisition of a covered foreign person engaged in prohibited activities by a U.S. person would also be allowed. Finally, to avoid grandfathering, prior limited partner commitments made before the date of the executive order would also be allowed.

Covered Foreign Person: A covered foreign person is an entity in a “country of concern” (i.e. the PRC including Hong Kong and Macau) or its affiliate company. The NPRM’s definitions make it clear that the parent entity in a “red chip” offshore structure for PRC businesses would count as a covered foreign person.

Covered Transaction: A covered transaction means M&A, equity investments, convertible debt investments, greenfield investments, joint ventures, and limited partnership investments that are not excluded.

The list does not include other commercial transactions that would fall outside the jurisdictional scope of “reverse CFIUS” as currently constituted, namely bank financing, private credit (as long as it does not have convertible or equity linked features), IP licensing transactions, and the sale of products. However, in a note in the NPRM, the foreclosure of equity collateral is still deemed as an equity transaction, meaning the scope of what is covered may be broad and broadened still in the future.

Prohibited Transactions: Investments in the fields of semiconductors, quantum computing, and AI are prohibited if they meet specified thresholds.

With respect to quantum computing, the effect of the current thresholds is to include virtually the entire ecosystem of advanced quantum computing.

With respect to semiconductors, the new standards in the APRM are tied in part to export controls on the export of advanced semiconductors and semiconductor equipment. The link to the export control standards provides further clarity on the prohibitions.

With respect to AI as stated above, there is a similar approach to set forth exact technical standards to address the public request for clarity.

In another link to the export controls regime, those on the “entity list” who engage in an activity that would otherwise require only a notification, would nevertheless be deemed to fall into the prohibited category of transactions. This is potentially significant as virtually all major PRC AI companies are on the “entity list”.

Notifiable Transactions: Notice is required for transactions in the fields of semiconductors and AI, which are not prohibited, but otherwise are above lower thresholds. The policy intent is for the U.S. Treasury to gain an understanding of these investments so as to determine whether or not to make them prohibited transactions in the future if the need arises in their discretion.

Penalties: The penalties proposed under the APRM are tied to those set forth in the International Economic Emergency Powers Act (IEEPA), which includes potential criminal liability. Identical to inbound CFIUS, a divestment order may also be issued, including after a transaction has completed.

For more information on how we can help you with U.S. corporate and compliance matters, please contact Charles Wu at Charles.Wu@clydeco.com

Decision Tree for Reverse CFIUS

Fin