À propos du rapport

Produit

10 février 2022

Écrit par:

TéléchargerCliquez sur chaque termes pour accéder aux articles correspondants

1. Introduction

Sentiment across the insurance industry is markedly positive, especially in the context of events of recent years. While 2021 saw the pandemic continue to shape the economic and political landscape, rising prices across all product lines, even those perceived as difficult, generated healthy top line growth for many insurance businesses.

The claims picture was relatively benign. Although there were a number of significant catastrophes, combined with some large attritional losses, there were no seismic events that would have depleted market capacity. On the flipside, inflationary pressures are starting to return and re/ insurance carriers are feeling the impact of rising costs on their operations. The war for talent has intensified post-COVID, as the industry cannibalises its own talent pool rather than look further afield.

For those businesses looking to expand, the decision on whether to grow through acquisition or by building out existing operations has never been more relevant.

To read the full report, click the download button.

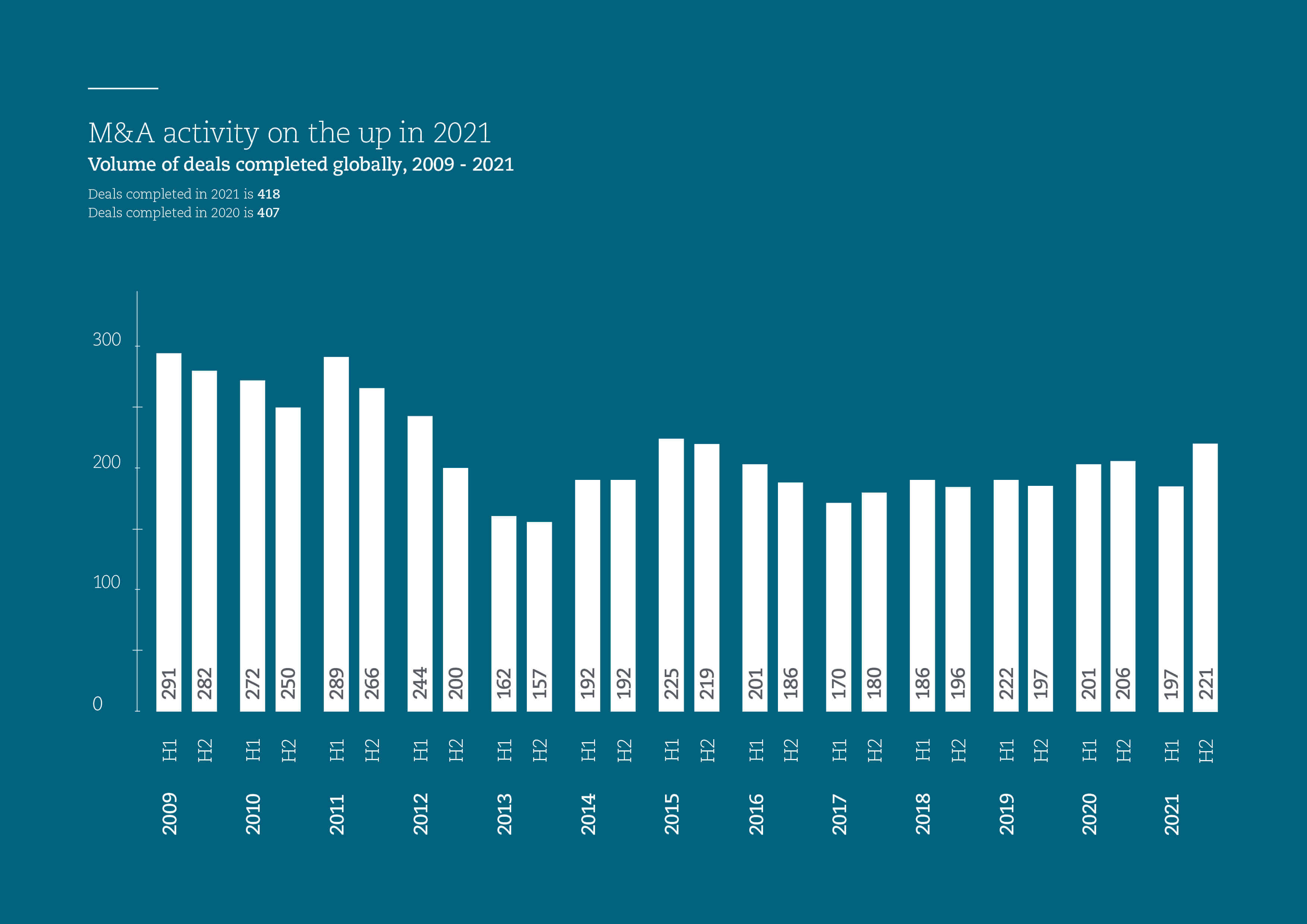

Despite having to suffer through another year of the pandemic, the global M&A market has held its nerve.

While there are new avenues to growth on the horizon, mergers and acquisitions continue to provide attractive opportunities for insurers to grow their businesses, expand into new markets and acquire new customers.

Following a particularly busy second half of the year for deal-making, M&A activity for 2021 as a whole was back close to the heights of 2019 levels.

Innovation takes centre stage - Insurtech companies are coming into their own as engines of growth for the insurance sector.

New business models are emerging - Developing ecosystems will be an important growth strategy for insurers in the year ahead

Build, buy or both? - Alongside, or as an alternative to acquisitions, insurers are also pursuing a number of avenues for generating organic growth

Run-off business proliferating worldwide - The legacy market remains a popular choice for the divestment of non-core assets, whether from P&C carriers and banks selling off life insurance divisions, or the spin-off of underperforming classes of business or subsidiaries due to market conditions.

A wider range of distribution channels - Bancassurance continues to be a growth market in Europe and Asia, notwithstanding the retrenchment of banks from life insurance business.

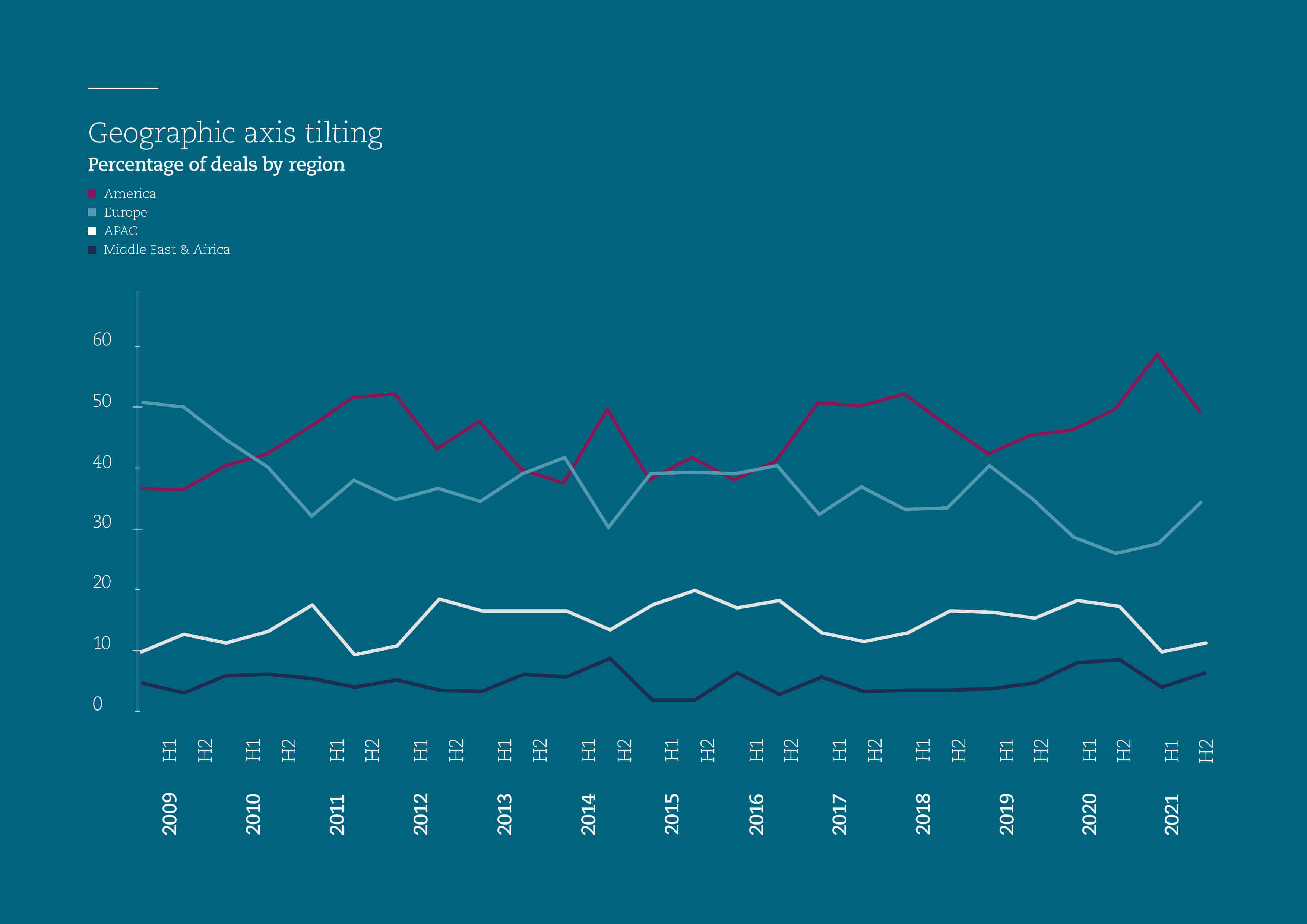

Despite a growing number of deals in Europe in 2021 the market still remains depressed post pandemic.

Regional focus shifting

There is lots of interest from potential buyers but there simply are not enough suitable targets. In contrast, general market sentiment in the is more buoyant, which propelled the country’s deal total in 2021 to a six-year high.

Meanwhile, in Asia Pacific, the on-going impact of COVID-19 continues to dampen appetite for M&A, and in MEA there was a notable uptick in activity in the second six months and we expect this trend to continue with further deals through 2022.

In 2021, there was a 9% increase in mergers and acquisitions involving foreign targets. Cross border deals accounted for 22% of the global total of completed deals, compared to 21% the previous year, with the US and the UK remaining the two most popular destinations with 21 and nine inbound transactions respectively.

Fin