About the report

Produced

25 March 2025

Written by:

Themes

Geopolitical outlook

Click each term to find out more

Analysing key M&A trends and identifying emerging opportunities

1. Introduction

Despite geopolitical uncertainty, high interest rates, and regulatory challenges slowing M&A, 2025 is set for a recovery. This year’s Insurance Growth Report builds on our 2024 findings, exploring the outlook for major M&A trends for 2025 and identifying emerging opportunities amid ongoing challenges.

Rising investor confidence, US policy shifts, and lower interest rates will drive deals, with the E&S sector attracting foreign investment. A strong dollar may fuel acquisitions in Europe and Asia, while regulatory changes in the Middle East could accelerate consolidation. MGAs will remain prime targets, and sellers must ensure their technology is integration ready.

While deal activity is expected to grow, a return to pre-pandemic levels is unlikely. Instead, insurers will focus on transformational acquisitions and strategic partnerships in local markets.

Economic and political uncertainty, coupled with rising transaction costs, led to a record low of 204 completed deals. Many insurers turned to MGAs as a flexible alternative to traditional acquisitions.

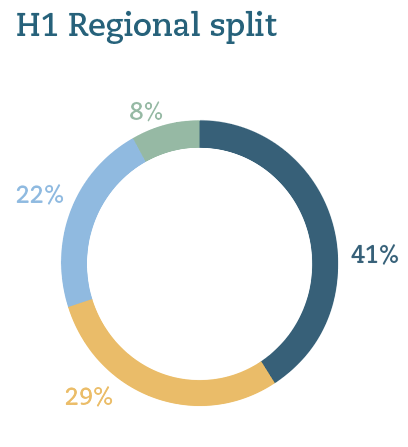

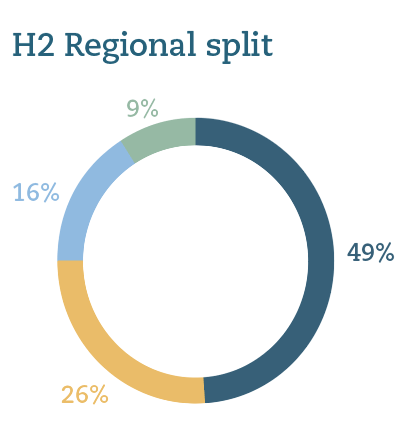

The US led in deal volume with 69 transactions, while the UK saw the most activity in Europe, driven by broker consolidation. Regulatory efforts in the Middle East, especially in the UAE and Saudi Arabia, spurred M&A, while APAC remained subdued.

Despite ongoing political tensions, 48 international deals were completed, including 12 cross-continental transactions. However, activity slowed significantly in H2, likely due to uncertainty surrounding the US and UK elections.

Produced

25 March 2025

Written by:

Themes

Geopolitical outlook

Produced

25 March 2025

Written by:

Themes

Geopolitical outlook

Regulatory shifts are both fuelling and restraining M&A. The US is easing restrictions, attracting more domestic and foreign investment, while the UAE uses oversight to drive consolidation. In contrast, strict regulations in Australia are slowing activity.

MGAs continue their global expansion, offering insurers a flexible way to enter new markets, tap niche opportunities, and fill capacity gaps with innovation and agility.

Large-scale global deals remain subdued, but regional players are actively pursuing dominance. Regulatory-driven consolidation in the Middle East and targeted acquisitions in markets like Italy and the UAE are set to shape the landscape.

As rates soften, high-demand sectors like Australian property, European specialty lines, and Middle Eastern reinsurance will attract deal-making despite their volatility.

Strong cyber resilience is now essential in M&A. Weak defences can impact valuations and even derail deals, making technology scrutiny a top priority.

After a record low in 2024, insurance M&A is set to rebound in 2025. Rising investor confidence in the US, regulatory easing, and potential interest rate cuts will drive deal activity, particularly in the E&S sector.

While uncertainties remain, the landscape for M&A is becoming clearer and more favourable.