Corporate risk radar

About the report

Produced

12 June 2024

Written by:

Click each term to find out more

Introduction

Our annual Corporate risk radar gathers insights from General Counsel (GCs) and their in-house legal teams, Board Directors, CEOs, and other senior C-Suite executives across various sectors worldwide.

In collaboration with Winmark, we surveyed 225 business leaders to delve into the risk landscape confronting organisations, assess their preparedness to navigate it effectively, and uncover the measures they are implementing to manage risk while capitalising on opportunities.

Leveraging insights gathered, the 2024 edition of our report highlights the strategies and innovative approaches that business leaders will employ to tackle the myriad of challenges and opportunities ahead.

There is a heightened perception of risk across multiple fronts as organisations grapple with a convergence of economic volatility, geopolitical turbulence, and the accelerating impact of AI.

While the results indicate an increased awareness of risk on various fronts, they also underscore a sense of enthusiasm from business leaders for cultivating the organisational agility, foresight, and resilience necessary to leverage an increasingly complex set of challenges.

We find ourselves operating in a much riskier world today than we did just a few years ago. Our clients are operating in a world that's more complex than ever.

Ben Knowles, Partner, Chair of Global Arbitration Group and Dispute Resolution Practice

Produced

12 June 2024

Written by:

Produced

12 June 2024

Written by:

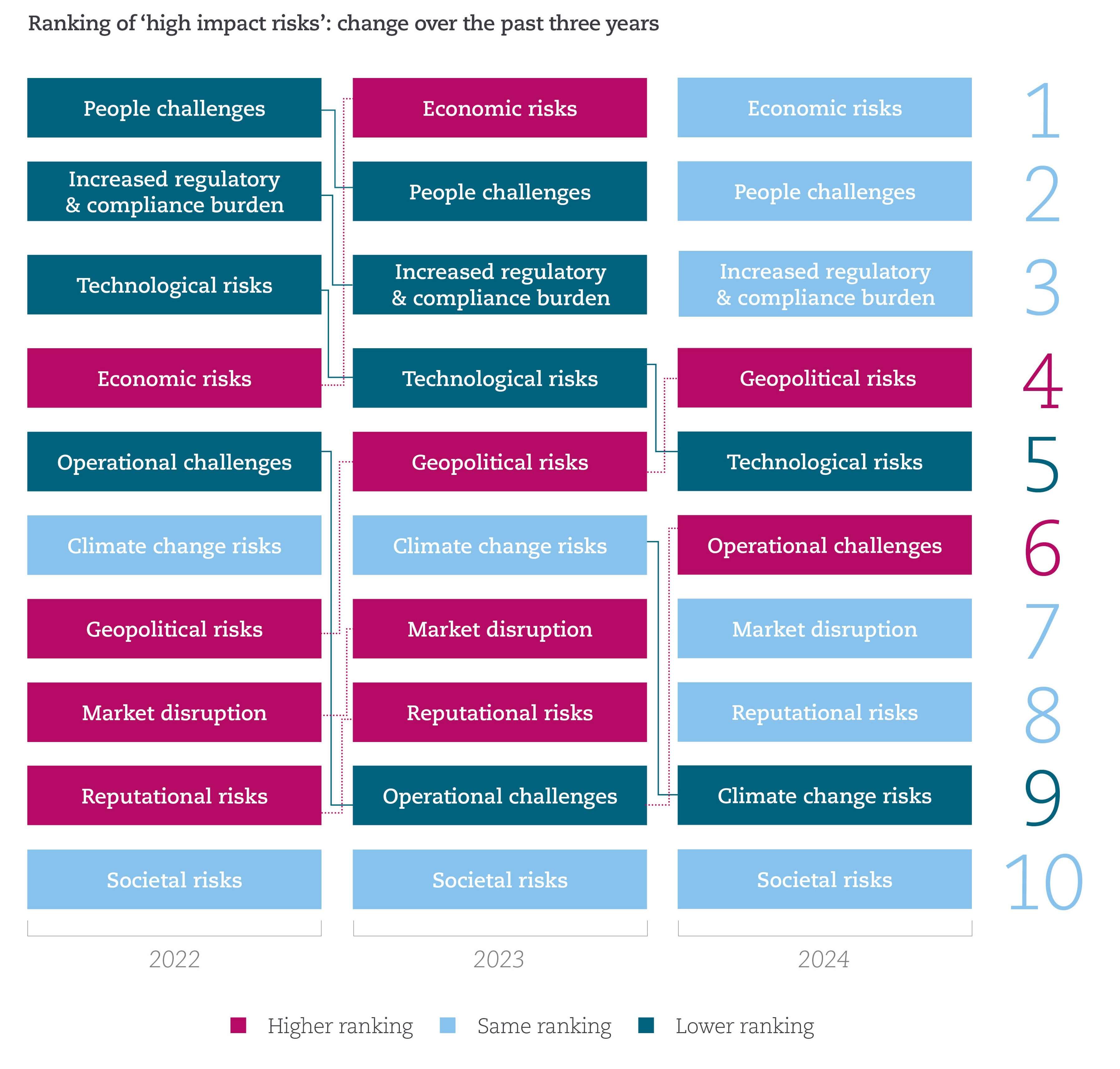

The three risk areas that business leaders expect to have the biggest impact in the next two to three years are economic risks, people challenges, and increased regulatory and compliance burden.

Economic risks came top the list of high-impact threats, with 82% of respondents highlighting concerns such as inflation, interest rates, and currency volatility.

Following closely, people challenges (58%) and regulatory/compliance burdens (also 58%) occupy second and third positions, respectively. Geopolitical risk notably escalates to fourth place over the past three years, propelled by persistent global conflicts and an impending contentious election cycle. Additionally, operational challenges, largely stemming from AI integration, have seen a significant uptick in 2024.

Economic risk

Economic risk is identified as the highest impact risk overall. 82% think it will have a high impact, and it is the top risk for board, GC, and C-Suite executive roles.

Increased interest rates and volatile currencies are having an impact across all global sectors, particularly the ability of businesses to attract capital and new investment as private equity funding moves to more stable markets. Construction firms, already operating on slim margins, are also particularly vulnerable to the impact of interest rate rises on the viability and profitability of their long-term projects.

Inflation is a massive risk for private equity. Their model is predicated on delivering high returns, which can be achieved in low-interest rate environments. But with rates as they are today, it becomes much harder. It’s the unpredictability that’s the issue.

Ben Knowles, Partner, Chair of Global Arbitration Group and Dispute Resolution Practice

People risk focus

People issues are identified as the joint second highest impact risk overall (58% think it will have a high impact).

Businesses grapple with the difficulties and costs of attracting and retaining a skilled workforce from a demanding and globally dispersed labour pool. Managing a geographically dispersed workforce with complex and varying employment law practices is a growing challenge, while maintaining data protection standards for remote employees adds further complexity to data security policies. As leaders recognise employees as being the backbone of their organisations, addressing people challenges is crucial to avoid further economic risk fuelled by high turnover or low productivity.

The tension between enabling a hybrid workforce while also maintaining compliance with data protection rules is posing challenges.

Rebecca Kelly, Partner, Regulatory & Investigations Group

Regulation risk

Regulatory & compliance risk has also increased significantly in 2024 - up by 9%. It is identified as the joint second highest impact risk overall, and is in second place in the risk hierarchy for GCs (74%).

The impact of widespread AI adoption is being felt here, with legal and tech teams needing to revise and update internal AI governance procedures and processes (for example understanding and complying with external frameworks such as The AIGA AI Governance Framework); and commercial leaders needing to grapple with new market entrants and business models.

The risk conversation is now much more in depth than it was ten years ago. Every element of liability is on the table being discussed up front. On arriving in a new country, companies now have detailed exit plans clearly articulating how they might exit a jurisdiction in years to come if the risks are too great. Inevitably, there’s going to be a certain amount of ‘Keep calm and carry on’. Large investments can’t suddenly move next day. It’s about understanding the risks and having clarity over the implications

Eva-Maria Barbosa, Partner, Clyde & Co

Market disruption

Market disruption risks have also increased significantly in 2024 - up by 9%, and again driven in part by the potential impact of AI.

AI is seen as a potential source of competitive advantage. However, it also comes with challenges, particularly in the realms of governance, job displacement, and cybersecurity; and there is something of a ‘gold rush’ atmosphere around AI development initiatives, with some fear about missing out on the potential benefits and being left behind. There are concerns about an AI arms race and the any competitive advantages from AI being short-lived as early innovations become commoditised over time.

Geopolitical risk

The risk area showing the largest increase is Geopolitical risk, up 11% since 2023 (from 43% to 54%), and now in fourth place in the ‘high impact’ risk hierarchy (up from seventh place in 2023).

We have to anticipate client reaction to changing market conditions, with so many elections this year there is a real chance of significant disruption and market turmoil. Choosing the right way to manage our clients' expectations is more of a threat than executing to give effect to the expected outcomes.

Chief Information Officer (CIO), Financial services, UK

Risk preparedness

The top three risks that leaders feel least prepared for remain unchanged. The most noticeable change in 2024 is the rise of market disruption to first place - up 11% from 19% in 2023 to 30%; and moving ahead of climate change, geopolitical and societal risks. The rapid pace of AI implementation is a key driving force behind this shift, particularly the impact of generative AI in disrupting business models and enabling new market entrants.

Respondent profile

225 interviews (215 online and 10 qualitative) with senior business leaders (our largest sample to date)

End