Looking Glass Report 2021/2022 – Part 2: A deep-dive into the new risk landscape

About the report

Produced

29 June 2022

Written by:

DownloadClick each term to find out more

1. Introduction

Following the launch of the first and second part of our annual Looking Glass report, this third and final part analyses the role of the General Counsel (GC). We explore how the GC role is adapting to an era where the Ukraine war, digital transformation, increasing regulation, the pandemic and climate concerns have been adding further complexity to an already challenging business risk environment. This year’s study finds GCs discovering a renewed sense of purpose, and enjoying an increasing recognition of their strategic value from Board Directors, CEOs and C-Suite executives.

The GC role continues to grow beyond strictly legal boundaries to expand into communications, reputation and crisis management tasks; and to play a central role in governance, leadership, strategic vision and change management.

Last year many GC and board respondents felt that the stress-test provided by the pandemic had given them a renewed sense of purpose that could be harnessed into the future. This year’s research suggests that a positive outlook has been maintained.

There is consistent agreement that a major factor driving change in the role is ‘Dealing with specific legal and regulatory developments’.

GCs also continue to perceive the need to deal with ‘Specific commercial risks that need to be managed’ as a stronger driver for change than board respondents.

In my experience, GCs and senior in-house counsel are under more and more pressure. Their workload is huge and working so closely with the business and the Board on their doorstep, there is no respite. I sense that this is a function of Boards placing more and more emphasis on the risk and compliance functions that the GC then has to take on in addition to all of the day-to-day classically “legal” responsibilities.

Chris Burdett, Partner, London

There is continued consensus between board respondents and GCs about the most important parts of the GC role, and this year several of the gaps in perception have narrowed significantly.

For three years in a row, perceptions of the GC role among board respondents have become more closely aligned with GCs’ own perceptions of what they do.

This year, we have evidence that says that C-suite executives across other departments also share these perceptions of the GC role, and recognise the valuable strategic contribution of the GCs.

The role of GCs has evolved from providing the Board with legal advice or legal analysis to being part of the Board’s critical and strategic decision making, and this is borne out in the report this year. The value of GCs is more than functional; they work closely with the business and have become a strategic asset in the boardroom. Through the pandemic, the Board has come to realise the importance and relevance of the expertise and unique skills of the GC and begun to draw on those expertise and skills in navigating through the labyrinth of conflicting legal and regulatory principles or managing crisis and reputation loss.

Mun Yeow, Partner, Hong Kong

Board respondents and GCs perceive ‘Being a trusted advisor to the executive, CEO and the board’ to be a key function of the role, and there is strong agreement that ‘Aligning the legal function to business strategy and context’ is important.

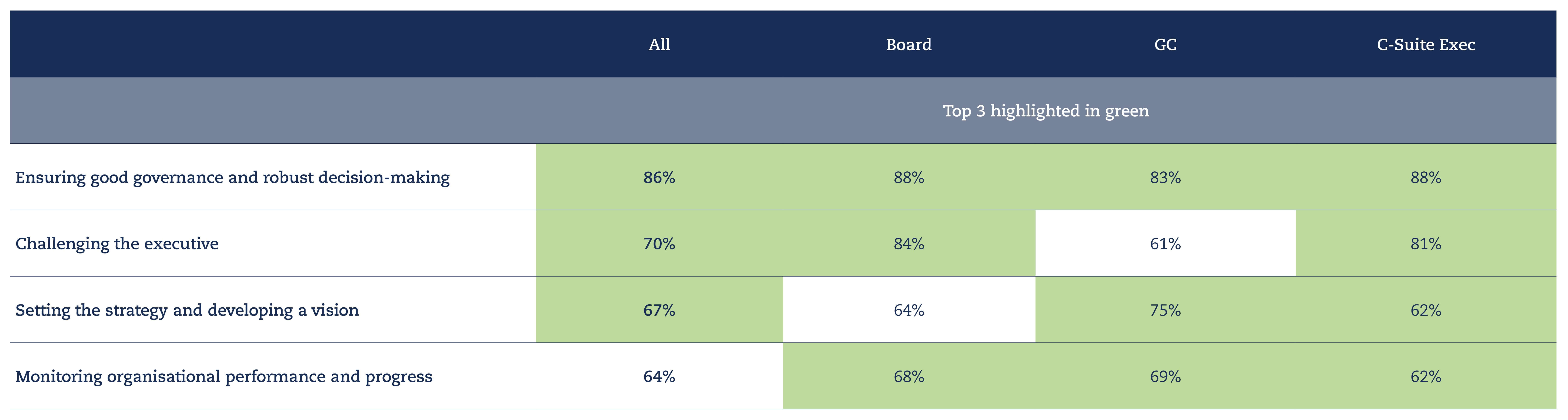

Board and GC views on the main elements of the boards’ role also remain well-aligned, and the hierarchy of importance is consistent over time.

Board respondents perceive ‘Challenging the executives’, ‘Staying up to date with the latest thinking, technology and best practice’, along with ‘Reviewing talent and succession planning’ as a more crucial part of their remit than is recognised by GCs.

The perception of GC performance has improved amongst board respondents.

68% of board respondents say GCs are performing well compared to 50% last year. This continues a trend of increasing recognition by the board of the contribution of the GC.

GCs are continuing to be asked to do more with less, with changing demands and cost pressures, especially against the backdrop of the pandemic. But equally, we have seen GCs recognising the need to change their perception as a ‘blocker’ – that they can’t just say ‘no’. Instead, they need to become an enabler – a creative decision-maker that collaborates with the board and C-suite on finding the right solutions for the benefit of the business.

Daniel Lever, Partner, Miami

Board respondents perceive that GCs share responsibility more evenly with the board and with other members of the executive and senior management team, seeing risk identification and management as an organisation-wide obligation.

C-suite executives perceive the senior executive team, along with the board, risk and compliance as having primary responsibility, with the legal department taking a secondary role.

It is surprising to see that this year many respondents do not consider staying up to date with the latest thinking, technology, and best practice as an important aspect of the board’s role. Even though we are moving beyond the rapid digital transformation necessitated by the pandemic, now more than ever, investment in technology is a crucial issue to get right. This is clear in the insurance industry, where GCs, boards and the C-suite need to collaborate to assess the risk around the clear opportunities to harness AI and automation, leverage data and introduce the right systems.

James Cooper, Partner, London

The majority of respondents agree that legal, risk, compliance and audit teams co-operate effectively to manage risk, but a quarter of them feel that roles and responsibilities could be more clearly defined.

End