About the report

Produced

24 March 2022

Written by:

DownloadClick each term to find out more

1. Introduction

Following the launch of the first part of our annual Looking Glass report at the end of last year, this second part takes a deep dive into three pressing risk management challenges for general counsel, their in-house legal teams and the senior board and C-suite decision makers with which they work – namely digital transformation and technology, climate change and post pandemic risk.

While the pandemic’s longer-term impacts continue to develop and crystalise, climate change and digital transformation loom large as more existential challenges.

In this part of the report, we have cast a spotlight on the impact of these themes on four core sectors – insurance, aviation, construction, and energy, marine and natural resources – as well as in our two areas of practice: corporate and advisory, and dispute resolution.

Business leaders are ambitious to improve and extend the capabilities of their remote working tech infrastructure, including technologies such as 3D modelling and AI, to enable remote communication and decision making between sales staff and clients.

Cyber threats remain the top technology risk. Instigating common policies and procedures across multiple countries and departments is a great challenge.

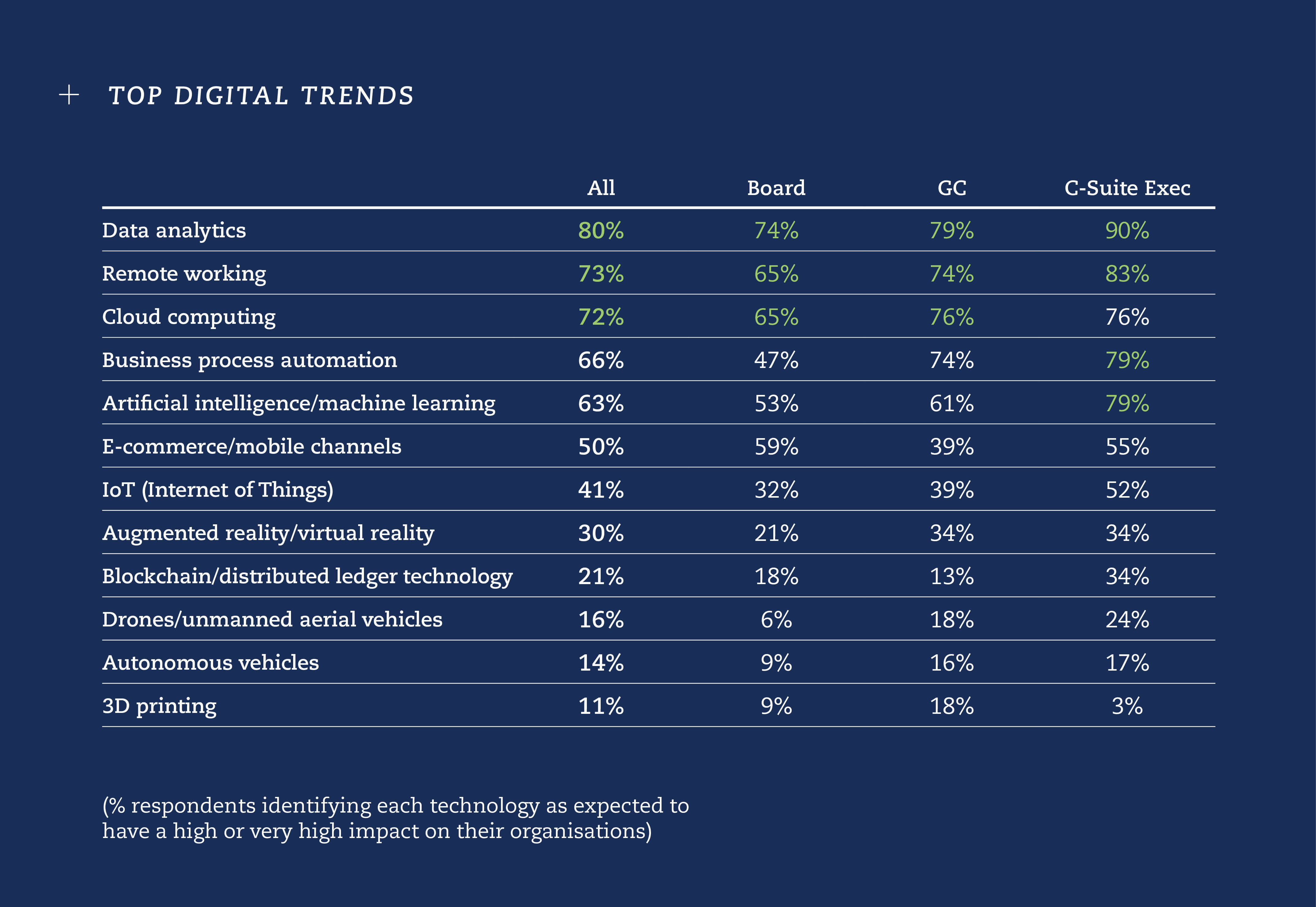

It is no surprise to see that the top trends in digital transformation are focused on increasing business agility and competitiveness. The forced switch to remote and hybrid working for many companies since 2020 has made the adoption of certain technologies critical to ensure that organisations can continue to operate and accelerated digitalisation across most industry sectors. Companies that can successfully adopt the benefits of data analytics, artificial intelligence and other advanced tools will undoubtedly gain a competitive edge, but they must move quickly to plug any knowledge gaps to ensure they are appropriately mitigating the associated risks

Dino Wilkinson, Partner, Clyde & Co, Abu Dhabi

The top three digital transformation and technology trends are data analytics, remote working and cloud computing.

AI is recognised as introducing new and complex implications for risk management. GCs will play a vital role in the development of ethical codes of conduct for the safe and fair implementation of AI.

Covid-19 accelerated the adoption of digital technologies but alongside the opportunities opened up by these technologies, come significant risk factors, especially in relation to cybersecurity and privacy, and potential regulatory action. Leaders will be required to determine what the biggest risks are for their organisations and to work with their IT, security, risk management and legal team to address these priority risks. The costs to get to grips with these risk factors are significant. But facing down risks will enable leaders to deliver efficiency and innovation for their businesses.

Thomas Choo, Partner, Clyde & Co, Singapore

Problems recruiting technologically skilled staff have been severely exacerbated by the skills shortage resulting from the pandemic.

In my sector, insurance, the pandemic has increased the urgency behind the adoption of insurtech. Suddenly there was an accelerated testing of all that had been happening in the last five to seven years, in turn enabling insurtechs to prove their case beyond what they would have been able to do under normal circumstances. The established industry saw like never before the urgent need to digitise. Insurance, like many other sectors, is starting to scrutinise every aspect of what it does and now it is ready to move forward with eyes wide open to digitise to an extent not seen before.

Vikram Sidhu, Partner, Clyde & Co

Climate change risk

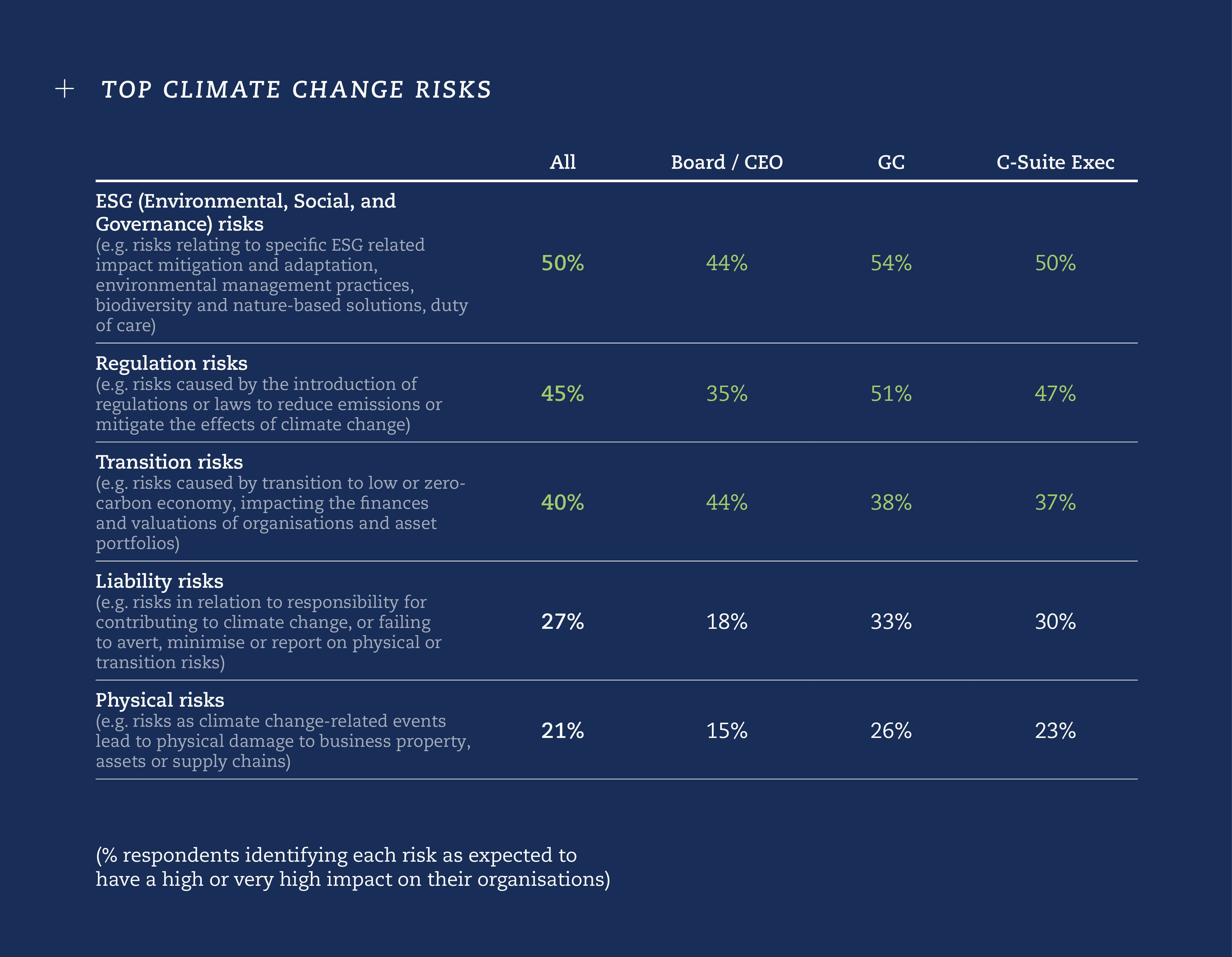

There is consistent agreement across all respondent types – Board, GC and C-Suite – that ESG, Regulation and Transition related climate risks will have the biggest impact over the next two to three years.

Organisations are seeing a shift away from the primacy of stakeholders towards balancing the interests of all stakeholders.

There is considerable pressure from government, regulators, investors and consumers for ESG in its broadest sense to be on the board agenda. Vocal stakeholders are demanding organisations set climate change targets and ambitions. The need to meet these demands is keenly felt, but so too is the need to manage recovery from the pandemic in a manner that does not compromise profitability.

It is not surprising that ESG has been identified as the risk with the highest impact. There is growing acknowledgment that ESG factors can directly bear on a company's financial performance, and that the risks and opportunities they give rise to should be taken into account by its board and reported to shareholders. But it continues to be a minefield for businesses as there is no consensus at the moment about what the E means, what the S means, and what the G means, or indeed the metrics behind them.

Nigel Brook, Partner, Clyde & Co

Organisations are considering whether they have a clear purpose that is compelling to employees, customers, suppliers, local communities and shareholders. The need to attract and retain younger staff is a key driver for this mindset.

Leaders are increasingly required to consider making decisions that could have a short-term negative impact on returns to shareholders, but may, in the long term, build a more valuable, sustainable business.

It’s clear that costs to reduce emissions will escalate as businesses face more stringent regulations, higher taxes, fines for non-compliance and the prospect of litigation. Perhaps even more significantly, these businesses will face scrutiny from their customers.

Mun Yeow, Partner, Clyde & Co, Hong Kong

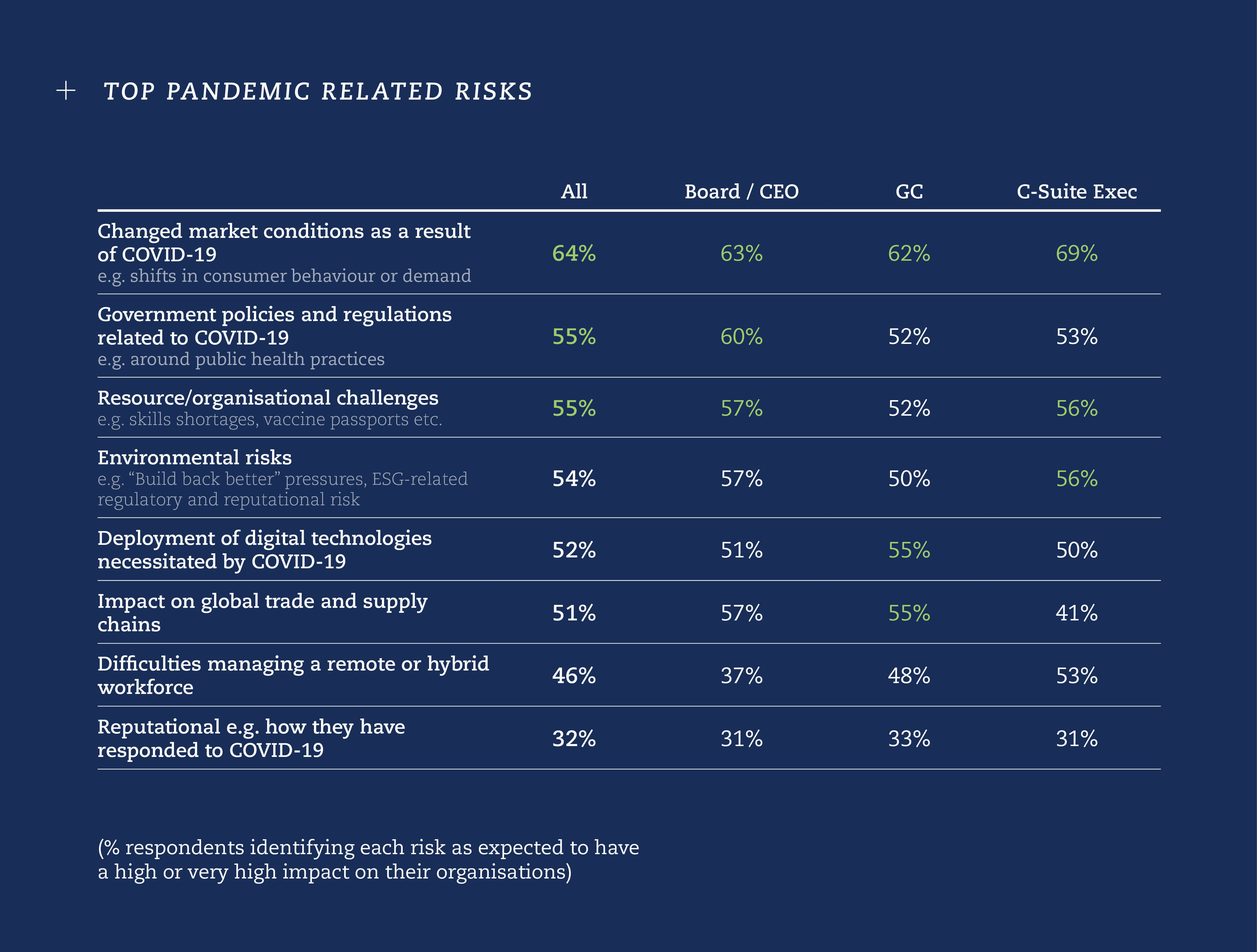

Board, GC and C-Suite respondents all agree that the pandemic-related risk with the highest impact will be ‘Changed market conditions as a result of Covid-19’ such as shifts in consumer behaviour or demand.

All organisations are assessing the long-term impact of the pandemic on demand for their products and services. Almost all recognise that at least some of the changes will be permanent.

Leaders are least prepared for ‘Resource/organisational challenges,’ ‘Impact on global trade and supply chains’ and ‘Difficulties managing a remote or hybrid workforce.’

The pandemic has caused businesses to rapidly embrace digitalisation, a transformation. That is and will continue to be driven by people with certain skills. Post-pandemic, we still need people, but perhaps with new talents and an altogether different skillset. Flexibility will be key. Working from home has in many cases brought pressures and strains on employed parents with young children – leading potentially to burn out – where they struggle to find a balance between their day job and caring responsibilities.

Mun Yeow, Partner, Clyde & Co, Hong Kong

The key challenges of the hybrid working model will be maintaining a positive culture and ensuring that new and younger staff are effectively integrated.

As the survey bears out, although we are two years on in the pandemic, businesses continue to face difficulties managing remote and now hybrid workforces. This year could be marked by difficult discussions between employers and employees. Yet it should also trigger important strategic decisions for businesses keen to determine not just how they emerge from Covid-19, but how they want to structure their businesses for smooth and efficient working in five or even ten years’ time. Those businesses that can navigate these discussions and decisions sensibly, reasonably, and successfully, could engineer competitive advantages in retaining and attracting talent.

Heidi Watson, Partner, Clyde & Co, London

The following section looks at how the findings outlined in this report apply to Clyde & Co’s four key sectors as well as the implications on dispute resolution and corporate and advisory aspects of the law, and what that means in real-world terms for decision-makers.

Covid-19, climate change risk and technological shifts are impacting almost all decisions and plans that leaders are making as they assess the changing landscape and plot their routes to recovery, resilience and growth.

Clyde & Co partners provide their insights on some of the major issues and risks that each sector is having to grapple with, both now and as they look ahead.

For many insurers whose business lines have traditionally thrived on personal contact, post-pandemic concerns around whether to continue remote or hybrid working remain a key issue for boards, C-Suite and GCS. Tough choices, as well as real positives, lie ahead.

James Cooper, Partner, says ‘Is Covid-19 an event that will start to fall away now, or will it lead to a change in the way risks are written? Will we see a modernisation of wordings or in how parts of the economy are rated for risk? These are interesting questions for leaders and GCs in the insurance industry.’

Aviation is still in the thick of pandemic-related disruption as operators look forward to recovery. However, the risks seen during the pandemic and those it continues to expose remain very much front of mind. On-going, fast-changing, country-specific public health and immigration policies are still restricting travel, while health concerns and uncertainty about changing immigration policies could dampen consumer demand for some time to come.

Carol Anderson, Global Aviation Professional Support Lawyer, says, ‘We’re not out of the woods yet, but a quick look at the history of aviation and its adaptability tells us that our industry continues to be resilient and will re-emerge stronger and fitter.’

The fallout from Covid-19 has had an extraordinary impact on the construction sector. On one hand, it has created heightened demand as governments look to stimulate their economies by investing in public infrastructure projects. On the other, boards, the C-Suite and GCs are wrestling with many significant pressures that have been exerted on the industry, squeezing already tight margins so much that we are starting to see insolvencies becoming a feature.

Beth Cubitt, Partner, says ‘For existing projects which were estimated on pre-pandemic norms, contracts were not drafted with these unforeseeable Covid-triggered extra costs in mind. Looking ahead, GCs will want to update those contractual mechanisms in new contracts as a matter of urgency.’

The combination of global trade and supply chain disruption, resourcing and organisational challenges and government policies and regulations around Covid-19 has had an unprecedented impact across what we see as the interconnected energy, marine and natural resources sectors, and the storm has yet to pass. With natural resource and energy production so reliant on skilled labour, ensuring that there is sufficient talent deployed in the right areas has not been easy.

Leon Alexander, Partner, says ‘Leaders must stay alert to the ESG, regulatory, transition and liability risks it poses, and ensure their policies on managing those risks are being implemented as a matter of urgency.’

From a transactional standpoint, the turbulence of Covid-19, the increasing focus on climate change resilience, and the drive towards digital transformation are all combining to put companies’ operations and levels of preparedness for risk under more intense scrutiny than ever before.

Stephen McKenna, Partner, says ‘There’s an obligation for buyers today to get even more under the hood of a target company, and understand its culture, how the business is driven, how people work and what the plan is for the future.”

Changed market conditions post-Covid could create fertile ground for disputes. Pandemic-induced disruption left many businesses unable to perform their contractual obligations, but there has so far been a general reluctance by counterparties to pursue claims against them.

“A lot of GCs will be being asked: does Covid amount to Force Majeure?” says Richard Power, Partner. “Although it comes down to the governing law of the contract and the facts of each case, there are lots of questions raised and there is certainly plenty of scope for disputes.”

End