U.S. Issues Final Rules Regulating U.S. Outbound Investments

-

Insight Article 07 November 2024 07 November 2024

-

Asia Pacific, North America

-

Regulatory movement

-

Corporate

On October 28, 2024, the United States Department of Treasury issued final regulations implementing “reverse CFIUS”, a mechanism by which the U.S., for the first time, will regulate U.S. outbound investments to “countries of concern” in specified sectors. This note will examine the particulars of the final regulations, as well as its practical implications for non-U.S. and non-PRC investors.

The “reverse CFIUS” mechanism was established through the issuance of an Executive Order by President Biden on August 9, 2023, Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern. On June 21, 2024, the Department of Treasury issued proposed regulations through a Notice of Proposed Rulemaking (NPRM). Following a public comment period, the Department of Treasury issued the final regulations, namely the Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern (the “Final Reverse CFIUS Regulations”). The Final Reverse CFIUS Regulations take effect on January 2, 2025.

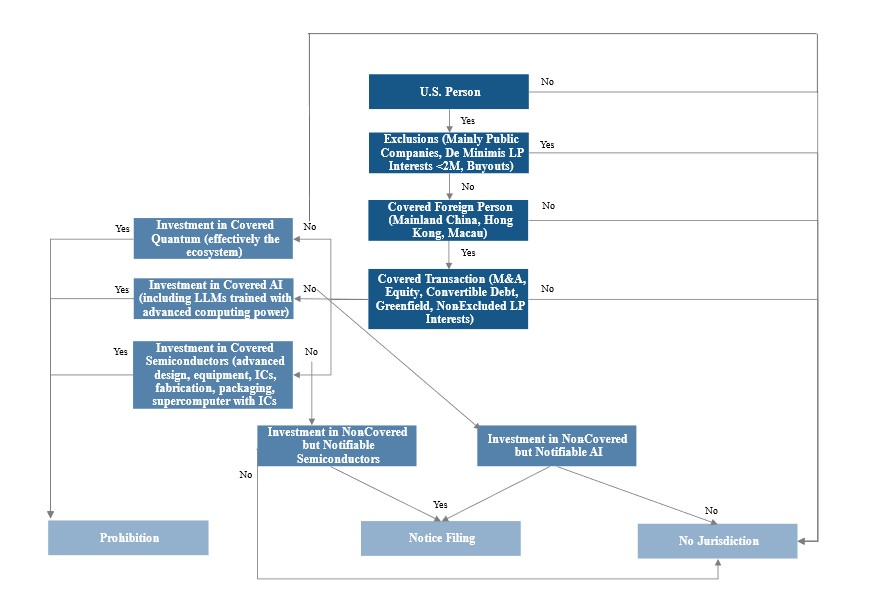

Appendix 1 sets forth a decision tree for the “reverse CFIUS” regime as currently constituted under the Final Reverse CFIUS Regulations.

Jurisdiction and Exemptions

U.S. Person: “Reverse CFIUS” applies only to U.S. persons, who are U.S. citizens, permanent residents, and U.S. entities.

Covered Foreign Person: A covered foreign person is an entity in a “country of concern” (i.e. the PRC including Hong Kong and Macau). The definitions are crafted to include the parent and intermediate entities in a “red chip” offshore structure for PRC businesses that engage in covered activities.

Furthermore, the Final Reverse CFIUS Regulations extends the definition of a covered foreign person to any entity in which a covered foreign person (first tier entity) holds a 50% or more voting, board, or equity interest (second tier entity), as well as any entity in which the second tier entity holds a 50% or more voting, board, or equity interest. The extension of jurisdiction to the third tier is a novel construct that goes beyond the second tier 50% rule in U.S. sanctions.

Limited Partner Investments: The NPRM contained two alternatives for defining the de minimis exception for limited partner investments in investment funds who invest in prohibited or notifiable sectors. The first would allow an exemption for so long as the U.S. limited partner’s fund commitments do not exceed 50% of the fund’s total commitments. The second would only allow an exemption if the U.S. investment is not more than US$1,000,000.

The Final Reverse CFIUS Regulations contained two exemptions (i) a U.S. investment of not more than US$2,000,000 or (ii) any investment where the U.S. investor has secured a contractual commitment from the general partner that the fund will not engage in a prohibited or notifiable transaction under the Final Reverse CFIUS Regulations.

Notably, the Final Reverse CFIUS Regulations elected not to provide an exemption for limited partner fund commitments that do not exceed 50% of the fund’s total commitments. In practice, given this limited safe harbour, USD funds with Chinese fund managers will have to decide whether to forgo investing in the prohibited or notifiable sectors covered by the Final Reverse CFIUS Regulations, or effectively forgo meaningful U.S. investment, thereby significantly altering the prior status quo where most Chinese fund managers of USD funds relied mainly on U.S. limited partner commitments.

Excluded Transactions: A U.S. person’s investment in the following are not covered under the Final Reverse CFIUS Regulations: (i) public securities, public funds, or derivatives that do not result in any equity rights, in each case, where the U.S. person is not afforded rights beyond the standard minority protections currently set forth in the CFIUS rules; (ii) M&A that result in a U.S. person controlling a non-covered business; (iii) the PRC subsidiaries of U.S. persons (i.e. multinationals) that do not engage in covered activities or maintain the covered activities they engaged in prior to January 2, 2025; (iv) seizure of collateral where the U.S. person is not the syndication agent or otherwise cannot direct the activities of the syndicate; (v) equity awards or options granted to U.S. persons by covered foreign persons; or (vi) any other activities exempted by the Secretary of the Treasury.

With respect to (iii) above, the practical effect is that U.S. businesses will not be able to engage in any new activities with their PRC subsidiaries going forward to the extent they are covered activities. The inclusion of such greenfield investments extends the jurisdiction of the Final Reverse CFIUS Rules beyond CFIUS, which excludes greenfield investments that do not involve an “investment” under CFIUS.

Prohibited and Notifiable Transactions

Covered Transaction: A covered transaction means M&A, equity investments, convertible debt investments, debt transactions that would result in governance rights (including the seizure of collateral that would result in a covered transaction), greenfield investments that are not excluded, joint ventures, and limited partnership investments that are not excluded.

AI: The Final Reverse CFIUS Regulations largely maintained the NPRM’s structure and prohibitions on U.S. investment in PRC AI companies that use computing power to train AI models exceeding a certain specified threshold. In practice, the current thresholds target AI large language models (LLMs), which required significant computing power. Notice will be required for computing power that is slightly below the prohibited threshold. These restrictions are in addition to the general prohibition on U.S. investment in PRC AI companies who develop AI systems for military applications.

Semiconductors and Quantum Computing: The Final Reverse CFIUS Rules largely maintained the NPRM’s prohibitions on U.S. investment in the semiconductor ecosystem (i.e. design, equipment, integrated circuits, fabrication, packaging, supercomputers with covered integrated circuits) and effectively the entire ecosystem for quantum computing. Notice will be required for integrated circuits that are slightly below the prohibited thresholds.

Penalties and Enforcement

Penalties: The penalties under the Final Reverse CFIUS Regulations are tied to those set forth in the International Economic Emergency Powers Act (IEEPA), namely i) a civil penalty equal to up to two times the value of the subject transaction or US$368,136, whichever is greater and/or ii) potential criminal liability. Identical to CFIUS, a divestment order may also be issued, including after a transaction has completed.

Enforcement: Referencing CFIUS enforcement as a guide, the most consequential penalty may not be the civil penalty, but the requirement to divest from a covered transaction within a short timeframe (e.g. up to 90 business days, the standard used in most CFIUS divestment orders). In practice, the consistent divestment orders imposed by CFIUS, which are not required to be disclosed to the public, have deterred many attempts by PRC investors to invest in U.S. businesses subject to CFIUS.

Potential Implications for Non-U.S. and Non-PRC Investors

Non-PRC, Non-U.S. Investment Funds: Private equity and venture capital funds with general partners in non-PRC, non-U.S. jurisdictions should not assume that the Final Reverse CFIUS Regulations do not apply to them. On the contrary, the limited exemptions for U.S. limited partner investments means that these funds will also have to face the choice to forgo investment in prohibited or notifiable transactions, or forgo receiving meaningful U.S. investment. This is true even if the general partner is from U.S. allies such as Canada, the United Kingdom, the countries in the European Union, and Australia. As a result, non-PRC, non-U.S. funds with global reach may consider forming separate parallel funds without U.S. investors, who will then invest in the sectors prohibited or notifiable under the Final Reverse CFIUS Regulations.

The Final Reverse CFIUS Regulations May be Expanded: The Final Reverse CFIUS Regulations should be viewed as a starting point, not an end. The list of “countries of concern” can increase, and the list of prohibited or restricted transactions can expand.

For M&A, venture capital, and other corporate practitioners, the need to understand U.S. regulatory laws with global reach, such as CFIUS, reverse CFIUS, export controls, sanctions, and FCPA, is paramount so as to properly assess all risks in global transactions.

Appendix 1

Decision Tree for Reverse CFIUS

For more information on how we can help you with U.S. corporate and compliance matters, please contact Charles Wu at Charles.Wu@clydeco.com

End